News & Discussion: Electricity Infrastructure

Re: News & Discussion: Electricity Infrastructure

You know listening to 5AA, Leon Byner who brings on actual experts in the industry, what they're doing isn't even actually needed.

Re: News & Discussion: Electricity Infrastructure

The new solar regulations address 2 problems, one present now and one future.

The new inverter regulations are aimed at increasing the strength of small solar to stay connected to the grid during voltage fluctuations...so that masses of home panels do not all disconnect from the grid at the same time during voltage issues. Has this ever happened?...not as far as I know but the experts at AMEO (Australian Electricity Market Operator) certainly believe it is a possible scenario.

The future problem is that the local grid could be overwhelmed by small solar during extremely low demand in the middle of the day. All SA's electricity demand could be supplied by small solar. Has this ever happened...no.....could it happen in the future...yes.....given the correct conditions. It would be a very low demand Sunday in spring or autumn (winter and summer demand is much higher) where there is no demand for SA electricity interstate, so excess generation can not be exported.

Remember small solar generated electricity is automatically sent into the grid (there is no on/off button....... until now)

Large wind/solar/gas/diesel plants can "turn off".

Will South Australia get to the stage where all local demand be met by small solar on these low demand Sundays?

Yes this is definitely a possibility in the near future given the uptake of solar by home owners and small businesses.

There are some easy short term solutions pushing the problem further into the future.....ask solar home owners to heat their hot water between 12-3pm

not 1201am as a lot of them are doing now.

Also WA has changed the solar tariffs to reflect need.......exporting home solar between 12-3pm now only earns 3 cents per hour, higher prices (10 cents) kick in after 3pm.

Re: News & Discussion: Electricity Infrastructure

From what I have heard, it is something that could be needed under a certain set of contrived circumstances. I guess "we" (all grid-connected users) benefit if the grid operators know the switch is there if they need it, so that they don't pre-emptively turn off suburbs just-in-case those circumstances arise. I think the inverters with the switch also have better ride-through settings so they won't just disconnect for themselves, and possibly also do a better job of making the waveform rather than just following it. That seems to be one of the big things that the Hornsdale Battery can do that had previously been the preserve of rotating metal. Presumably if a distribution run can be fully supplied by local generation (rooftop panels), there needs to be something defining the waveform.

Hopefully having the ability will mean it is never needed. Unfortunately that will mean the nay-sayers will continue to claim it was never needed.

Re: News & Discussion: Electricity Infrastructure

So if the grid cant cope with all this new tech and whatever, why haven't SAPN upgraded their infrastructure? Or are they waiting for the tax payer to pay extra for that too? Oh wait, they are, they want to charge what was it again, an extra fee of $20 or 30 per?

And what part of the grid, where, wont it be able to cope? Why no specifics? Why just vague reasons?

For how long have governments been flogging their subsidies for people to take up solar at home and in more recent times install home battery setups?

For how long has it been known that they want to get as many households and properties on solar....?

If the grid or system can't cope with the extra power being fed in to it, why aren't they building more battery farms like the Tesla one at Jamestown? Why aren't they selling the electricity on the national market to the state we are connected with?

How is any of this a surprise to them that they now need to react how they have? What have they been doing all these years?

The amount of inverters now able to be sold has been cut from 80+ I believe, to just 3 or 4 which allow them to remotely control your solar setup and switch you off.

The consumer getting ripped hard again as usual, and the majority roll over and others make excuses.

Oh well maybe Leon Byner will wake up enough people or piss in the right ears to get something done.

We used to joke that you would be taxed to breath one day, the one things are headed with these bastards they'll soon tax that too.

And what part of the grid, where, wont it be able to cope? Why no specifics? Why just vague reasons?

For how long have governments been flogging their subsidies for people to take up solar at home and in more recent times install home battery setups?

For how long has it been known that they want to get as many households and properties on solar....?

If the grid or system can't cope with the extra power being fed in to it, why aren't they building more battery farms like the Tesla one at Jamestown? Why aren't they selling the electricity on the national market to the state we are connected with?

How is any of this a surprise to them that they now need to react how they have? What have they been doing all these years?

The amount of inverters now able to be sold has been cut from 80+ I believe, to just 3 or 4 which allow them to remotely control your solar setup and switch you off.

The consumer getting ripped hard again as usual, and the majority roll over and others make excuses.

Oh well maybe Leon Byner will wake up enough people or piss in the right ears to get something done.

We used to joke that you would be taxed to breath one day, the one things are headed with these bastards they'll soon tax that too.

Re: News & Discussion: Electricity Infrastructure

I am not an electrical engineer, so this is only what I think I have understood.

The batteries at Jamestown, Yorke Peninsula and in the South East are on the Electranet transmission grid. Rooftop solar is on the distribution grid, and has generally been modelled as a reduction in demand. I believe that part of the application to install panels has included checks on the local network. I assume that until recently/soon, the demand at the local level could be assumed to exceed generation.

I don't know if transformers can automatically (or even under control) change from moving electricity from the higher voltage network down tot he lower voltage distribution to going the other way. If that change requires new or upgraded hardware, there are a lot of local transformers scattered around the suburbs that would need upgrading. Even if they can transmit electricity in either direction, someone possibly needs to make sure that every local line has a source of waveform timing etc (so-called FCAS on the transmission grid). I gather this can come with the electricity when it is flowing from the big grid to the small one, but maybe not in the other direction. The newer model inverters that are now mandated, and Tesla etc batteries, might be able to provide that timing. Older inverters probably don't, which isn't an issue while every street is always consuming more electricity than it generates.

If every house in the street has most of its roof covered in efficient panels, then the residents go out for the day with the airconditioner turned off, the fridge and standby power on the TV are not going to consume all the electricity generated on that house. If the entire street is like that, the street needs to be treated like a generator and follow the same kinds of rules. These kinds of rules weren't enforced on the first wind farms either. I'm not sure if they have been retrofitted, but the requirements for "playing nice" on new wind farms now are a lot stricter than they were 20 years ago. Now the home solar market needs to be regulated in the same way, for much the same reasons.

The batteries at Jamestown, Yorke Peninsula and in the South East are on the Electranet transmission grid. Rooftop solar is on the distribution grid, and has generally been modelled as a reduction in demand. I believe that part of the application to install panels has included checks on the local network. I assume that until recently/soon, the demand at the local level could be assumed to exceed generation.

I don't know if transformers can automatically (or even under control) change from moving electricity from the higher voltage network down tot he lower voltage distribution to going the other way. If that change requires new or upgraded hardware, there are a lot of local transformers scattered around the suburbs that would need upgrading. Even if they can transmit electricity in either direction, someone possibly needs to make sure that every local line has a source of waveform timing etc (so-called FCAS on the transmission grid). I gather this can come with the electricity when it is flowing from the big grid to the small one, but maybe not in the other direction. The newer model inverters that are now mandated, and Tesla etc batteries, might be able to provide that timing. Older inverters probably don't, which isn't an issue while every street is always consuming more electricity than it generates.

If every house in the street has most of its roof covered in efficient panels, then the residents go out for the day with the airconditioner turned off, the fridge and standby power on the TV are not going to consume all the electricity generated on that house. If the entire street is like that, the street needs to be treated like a generator and follow the same kinds of rules. These kinds of rules weren't enforced on the first wind farms either. I'm not sure if they have been retrofitted, but the requirements for "playing nice" on new wind farms now are a lot stricter than they were 20 years ago. Now the home solar market needs to be regulated in the same way, for much the same reasons.

Re: News & Discussion: Electricity Infrastructure

Another article discussing inverter standards/small solar output re the grid.

From EcoGeneration

From EcoGeneration

South Australian regulations for new solar power systems: GSES

As a result of the huge uptake of grid-connected PV systems in South Australia, the Australian Energy Market Operator (AEMO) is projecting significant system security risks to the South Australian electricity supply network. As a result, the South Australian Government will be implementing some new requirements for PV systems, known as Regulatory changes for Smarter Homes, from September 28, 2020.

Despite the reference to homes in its title, these changes apply to all grid-connected PV systems, residential or otherwise. In short, installers will be required to:

Install inverters that have low voltage ride-through capabilities and are listed on an approved inverter list;

Ensure the system owner appoints a Relevant Agent who can perform remote disconnection and reconnection of their grid-connected PV system; and

Install inverters that have internet capability and an onboard communications port.

There will be additional requirements for dynamic export control which will require active control of the inverter. However, these requirements are still in development and will be implemented from July 2021.

These requirements have caught many in the industry by surprise, and as a result the list of approved inverters and agents is small. Some inverter manufacturers have already tested their inverters and proved compliance, and in other cases have simply ‘declared’ that they are compliant and will finish the testing later.

This technical article will summarise the implications of the new technical standards for grid-connected PV systems being installed on the network.

A list of approved inverters is available here.

A list of approved agents is available here.

Background

In May 2020, in response to a request for information from the South Australian Government, AEMO released a report advising the minimum operational demand required to maintain a reliable electricity supply to the state and the analysed the supply disruption risk posed by lowering daytime demand due to the high level of solar generation.

Operational demand in a region is demand that is met by local power plants (including large-scale renewables) and imported generation. This excludes any demand that is met by small local generation e.g. rooftop solar. The report highlighted that rooftop grid-connected PV installations are growing rapidly – more than 200 MW a year is being installed in the state, consistent with the AEMO’s high DER uptake scenario.

Figure 1: Actual and projected capacity of distributed PV in South Australia. Source: AEMO.

Under the high DER scenario, AEMO projects that operational demand could reach zero within 1-3 years (Figures 2 and 3). Figure 3 takes the day with the lowest demand in 2019-20, November 10, 2019, projected forward with an annual growth rate in distributed PV of 219 MW with the increase in distributed PV, operational demand will be especially impacted during the middle of the day and that we can start seeing zero daytime operational demand by late 2022.

Figure 2: Minimum operational demand projections for South Australia. Source: AEMO.

Grid-connected PV systems effectively reduce the amount of operational demand due to their behind-the-meter nature. If there is no operational demand on the network, traditional dispatchable power stations cannot operate. This is problematic because these generators provide essential network services such as maintaining the power system strength, inertia, frequency and voltage. Distributed grid-connected PV systems do not provide these services.

Disconnection of distributed PV

A problem with the high level of distributed PV system penetration on the South Australian network is caused by a safety feature within these systems’ inverters, which shuts the system down when it senses grid disturbances such as very high or very low voltage from the grid. As the level of penetration of distributed PV systems is anticipated to increase, if a large number of PV systems are suddenly disconnected due to a voltage disturbance, it will significantly impact the stability of the power supply.

In the same report to the South Australian Government, AEMO conducted an analysis of distributed PV disconnection behaviour from historical voltage disturbances between 2016 to 2020. It found that voltage disturbances on the network can lead to tripping of PV systems. For example, a severe fault in the network near the Adelaide metro area, such as a power plant suddenly disconnecting, could lead to simultaneous tripping of up to half of the rooftop solar in South Australia, an estimated 200-400 MW of solar generation by the end of 2020. This means that a contingent power plant now needs to be much bigger to cover for loss of generation from both solar and the disconnected plant.

The disconnection of distributed PV was related to the severity of the voltage disturbance (Figure 4). In the most severe voltage disturbance analysed, disconnection of more than 40% of distributed PV in the region was observed.

Figure 4: Percentage of distributed PV sites in a region observed to disconnect following historical voltage disturbances. Source: AEMO.

Minimum load requirement

South Australia is electrically connected to Victoria and the rest of the National Electricity Market (NEM) via the Heywood interconnector. It is a critical element in maintaining frequency and helps balance variances in demand and supply in South Australia’s network. When the link is down, South Australia becomes islanded from the NEM and requires a minimum amount of load required to provide grid stability. Currently this is at around 550 MW, and is set to decrease to 450 MW by 2021 when additional synchronous condensers are installed.

To manage their power system security during high levels of distributed PV generation, AEMO recommended the implementation of a backstop mechanism to curtail distributed PV generation via South Australia Power Networks (SAPN) during abnormal system conditions. This mechanism was trialled in February 2020 during a disconnection of the Heywood Interconnector.

Following the advice from AEMO, the South Australian Government has introduced a range of new technical standards and requirements (under the Smarter Homes mandates) which come into effect in South Australia on 28 September 2020. These include the following:

Voltage ride through standards for grid-connected inverters;

Remote disconnection and reconnection requirements for distributed generating systems; and

Export limit requirements for distributed generating systems.

Low voltage ride through requirements

This requirement applies to all new grid-connected PV inverters connected to the network. For existing systems, this requirement comes into effect if the current inverter is being replaced outside of the warranty.

The new technical standard specifies that all low voltage inverters must meet testing standards outlined in Appendix G.2 of AS/NZS 4777.2:2015 and a supplementary short duration undervoltage response test (VRDT) developed by AEMO.

Section 7.4 of AS/NZS 4777.2:2015 stipulates that an inverter must provide the following passive anti-islanding protection in response to undervoltage on the grid:

Has a trip delay time of greater than 1 second if the voltage falls below 180 V;

Remain in continuous and uninterrupted operation (i.e. ride through) for voltage variations under 1 second; and

Provide anti-islanding measures beyond 1 second and before the maximum disconnection time of 2 seconds.

The current testing procedure in Appendix G.2 of AS/NZS 4777.2:2015 confirms that an inverter will trip after one second for incremental voltage reductions (in steps of less than 1 V from 182.5 V to 177.5 V, with a dwell time of 5 seconds for each voltage step).

However, AS/NZS 4777.2’s testing procedure only tests an inverter’s response to slow voltage sag and not during a short duration voltage step. It also does not sufficiently test whether an inverter can remain connected for faults with a duration of less than one second.

AEMO’s VRDT test checks whether the inverter meets the 1 second trip delay requirement when the grid voltage drops suddenly below 180 V, and that it will ride through the low voltage (i.e. remain connected and operating) if the drop lasts less than the trip delay. The values are selected based on the distribution clearance times and potential transmission level events.

The test seeks to confirm two aspects of the inverter’s behaviour:

The inverter remains connected during an event where the voltage reduces to 50 V and consequently returns above 180 V within 1 second (after 220 ms, to be precise); and

The inverter stays connected for at least 1 second following a sudden event where the voltage remains below 180 V. Maximum disconnection time of 2 seconds still applies.

Smart home requirements

Responsibilities of system owners or operators

The owner or operator of the PV system must ensure that the inverter installed is featured on the approved inverter list.

Responsibilities of installers

Installers must install only inverters that are listed on the SA Govt’s approved inverters list. At this stage, 25 inverter brands comply, and more are expected to come soon.

For existing grid-connected PV systems, this requirement will come into effect when the existing inverter is being replaced, unless the inverter is being replaced under warranty.

For grid-connected PV systems that do not exceed 30 kW, like-for-like warranty replacement of inverters will not be required to be compliant with SAPN’s technical standard (TS129), unless the capability exists within the replacement inverter. If the capability exists, the inverter’s settings must be updated to the current standard (particularly the inverter’s power quality response settings). For grid-connected PV systems above 30 kW, all inverters must be compliant with SAPN’s technical standards.

Responsibilities of inverter manufacturers and importers

Manufacturers and their importers must complete and submit these test results to the SA Govt prior to 25 September 2020. The SA Govt is in the process of developing a list of compliant inverters that have undergone the VRDT test.

However, manufacturers and importers can also enter into a legally binding arrangement with the SA Govt to be provided with a transitional period to 31 March 2021 to complete the VRDT testing under a set of conditions. These conditions include:

Must commit to complete the testing by the transitional period end date;

Provide test reports showing that the inverters meet the VRDT test;

Must commit to make good any inverter installed during the transitional period if the inverter fails the VRDT test, at no cost to the customer, installer or supplier.

The SA Govt will be frequently updating the approved list of compliant inverters.

Remote disconnection and reconnection requirements

All new grid-connected PV systems installed after 28 September 2020 must be capable of being remotely disconnected and reconnected by an agent registered with the Technical Regulator (relevant agent). This requirement also applies to existing grid-connected PV systems where a grid-connected inverter or multimode inverter is being replaced outside of the warranty or intended to be relocated to a different building within the same electrical installation. If these components in an existing system are being repaired, replaced under warranty or relocated to another position on the same building, this standard will not apply.

A relevant agent is a party authorised by the owner or operator of a grid-connected PV system. They remotely ramp down or disconnect and reconnect a grid-connected PV system only when legally directed by SAPN (in accordance with the grid-connection agreement) and AEMO.

A list of relevant agents can be found on SA Govt’s website, and is frequently being updated.

For example, Solar Analytics is a listed relevant agent. One of their solutions uses the inverter’s internet connection (Wi-Fi, ethernet or 4G) to actively manage its export limit settings via the cloud (API). Solar Analytics will receive and act on the control signals from AEMO and SAPN, and will notify installers and solar owners during these events.

To be technology neutral, the SA Govt has released a range of deemed methods (i.e. types of declared components) that can be utilised within a grid-connected PV system to facilitate disconnection and reconnection by a relevant agent. This includes the following:

A device connecting to the DRM port of the inverter which asserts a DRM 0 or a DRM 5 signal; or

The following list of devices under the condition that they can receive a signal from the relevant agent causing it to operate the disconnection device or limit the exported energy to zero:

Direct communication channel to the inverter

Electricity meter

Central Protection Unit (CPU) or Network Protection Unit (NPU)

Supervisory Control and Acquisition (SCADA) system

Relevant agents can also enter into a legally binding arrangement with the SA Govt to be provided with a transitional period to 31 December 2020 to complete preparation activities to enable remote connection and disconnection measures. Under this process, they must show that they have demonstrated these measures by 1 January 2020.

Relevant agents who apply after 31 December 2020, or who have no need of the transitional arrangement will be required to demonstrate their technology as part of the registration process.

Standard requirements

Responsibilities of system owners or operators

The owner or operator of the grid-connected PV system must:

Select a Relevant Agent, featured on the list of relevant agents;

Authorise the relevant agent to perform the remote disconnection and reconnection; and

Inform the relevant agent if ownership of the grid-connected PV system is going to change, e.g. when a house with solar is sold.

Responsibilities of installers

Installers need to ensure a relevant agent has been nominated for the installation. Installers should help the system owner to select a relevant agent who will limit their solar export if required by AEMO or SAPN. It should be double checked that the relevant agent is registered and approved prior to installation. The relevant agent needs to be nominated as the installer completes the Certificate of Compliance.

Installers are also responsible for installing a system that is capable of being remotely disconnected and reconnected from the distribution network by the relevant agent.

Responsibilities of relevant agents

When the relevant agent has received direction from SAPN or AEMO, they must activate the remote disconnect and reconnect capability of the grid-connected PV system.

Directions may require the relevant agent to disconnect or reconnect:

Some or all of the grid-connected PV systems under their control;

A specific grid-connected PV system;

Multiple grid-connected PV systems (in terms of number or within specific locations of the SAPN distribution network); or

A certain level of megawatts.

Relevant agents must be capable of undertaking the direction within 15 minutes of advisement and must be capable of doing so during daylight hours during the week. After completing these directions, they must inform the directing party (SAPN and/or AEMO).

Export limit requirements

In accordance with the National DER Connection Guidelines, SAPN had already introduced an export limits for grid-connected PV systems, whereby:

As of 1 December 2017, single phase can export a maximum of 5kW; and

As of April 2019, three phase systems can export a maximum of 5kW per phase.

Due to the expected growth in distributed PV systems, SAPN has recognised the use of dynamic export limits in their 2020-25 regulatory proposal. In the plan, they have introduced a low voltage management business case which includes dynamic export limits. This new business case seeks aims to align with their ‘feed in management approach’ that has been developed for large embedded generators connected to the network. This approach is anticipated to involve publishing dynamic export limits to customers and DER aggregators, and the ongoing publication of dynamic export limits to small embedded generators, aggregators and virtual power plant operators.

To avoid grid stability issues caused by high levels of PV exports, the new technical standard requires remote updating of inverter export limits.

From 28 September 2020, all new distributed PV systems must feature internet capability and possess an onboard communications port that can be used to connect to another device (e.g. via ethernet, USB and RS-232). If an inverter can communicate wirelessly (e.g. by providing a secure Application Programming Interface (API) over Wifi), that can also be used for connection to another device in lieu of a physical communication port.

This requirement also applies to existing grid-connected PV systems if a grid-connected inverter or multimode inverter is being replaced outside of the warranty, or is intended to be relocated to a different building within the same electrical installation. If these components in an existing system are being repaired, replaced under warranty or relocated to another position on the same building, they are exempt from this requirement.

The additional requirements for dynamic export control are still being developed and will be implemented from 1 July 2021.

Standard requirements

Responsibilities of installers

Installers must install inverters that have internet capability and an on-board communications port, so that is capable of dynamic export limitation.

Installers must only carry out work of connecting the grid-connected inverter (and submit the grid-connection application) if it complies with the technical standard.

Implications of these changes

While there is urgency in ensuring the distributed PV systems do not contribute to instability of the South Australian grid, the South Australian Government introduced these requirements on relatively short notice. Check with your supplier to see if the inverters you hold are being retested as an approved product, as non-approved products can only be used as replacement under warranty.

Installers will likely need to help their customer select an appropriate relevant agent for remote disconnection and install any additional components to ensure the agent can operate the system remotely. It is unclear still how often PV systems will be asked to ramp down or disconnect in the future or whether there will be further complications with this function, although as this capability is reserved for emergencies only, interruptions are likely to be limited.

South Australian Government Webpage on Regulatory Changes for Smarter Homes: https://energymining.sa.gov.au/energy_a ... rter_homes

South Australian Power Network 2020-2025 Draft Plan: https://www.talkingpower.com.au/DraftPlan

https://www.ecogeneration.com.au/south- ... tems-gses/

Re: News & Discussion: Electricity Infrastructure

Plans for 2 new solar farms, one at Australia Plains in the mid-north, north of Eudunda and the other at Morgan on the River Murray.

From Renew Economy

From Renew Economy

Plans revealed for two new big solar farms in South Australia

South Australia-based renewables developer, Green Gold Energy, has revealed plans to develop two new major new solar farms in that state, a 185MW project in the south-eastern town of Australia Plains and a 120MW project in nearby Morgan.

Green Gold said earlier this month that it had been developing the early stages of the project over the past 18 months, alongside investors including Golden Invest, Edel New Energy, and Astronergy, or Chint Solar. Consultations with the local communities were held in August.

The company says the sites for the two projects, which are spaced around 50km apart, were acquired in the third quarter of 2018 and the development application process started shortly thereafter, in November of 2018.

All going well with government and network approval, GGE says the prospective projects are scheduled to begin construction in the third quarter of 2021, to be completed in 2022, and implemented in 2023.

“Presently, the pandemic is still severe, which has had a negative impact on the global economy,” the company said in a statement. “However, these new projects will create approximately 600 jobs, including 20 long-term positions that will last for 30+ years. These projects promote local employment opportunities and boost local economy.”

Chint New Energy has been named as the EPC partner of the projects, and GGE says local workers and suppliers will be prioritised for project construction.

Green Gold has previously specialised in much smaller projects, developing more than 150MW of 5MW solar farms in mostly South Australia, 90MW of which has been granted approval and 50MW of which is either under construction or energised.

“By virtue of its endeavours, Green Gold Energy has successfully established itself as a professional and experienced solar farm company with rapid business growth with at least 80MW successful development annually,” the company said.

GGE also said in the statement that the larger projects had attracted the attention of “many fund companies and energy companies” which had expressed interest in acquisition.

On the grid, the Australia Plains plant sits near to South Australia’s Robertstown substation, while the Morgan project will connect to the North West Bend substation, providing electricity for both South Australia and Victoria.

Additionally, a new 330kV, over 900km overhead transmission line with approximately 800MW transfer capacity has been approved by AER, connecting the Robertstown substation to the Wagga substation in New South Wales, with an added connection to north-west Victoria.

The company said that it had received notice in the second quarter of this year from S.A. network owner ElectraNet and the Australian Energy Market Operator that the projects were undergoing the in Generator Performance Studies (GPS) process.

“The [community] … events hosted by Green Gold Energy … were hugely successful,” the GGE said. “The strong support of local community, the smooth development of the project, has played a positive role in stabilising electricity prices and making up for the electricity gap.

“The Australia Plains and Morgan projects will be the milestone achievements in the development of solar energy within South Australia.”

https://reneweconomy.com.au/plans-revea ... lia-74084/

Re: News & Discussion: Electricity Infrastructure

South Australia achieves 66% share renewable electricity production in September.......a record.

And Australia 30%.... also a record.

From Renew Economy

And Australia 30%.... also a record.

From Renew Economy

September delivers record high renewable share on NEM, new low for coal

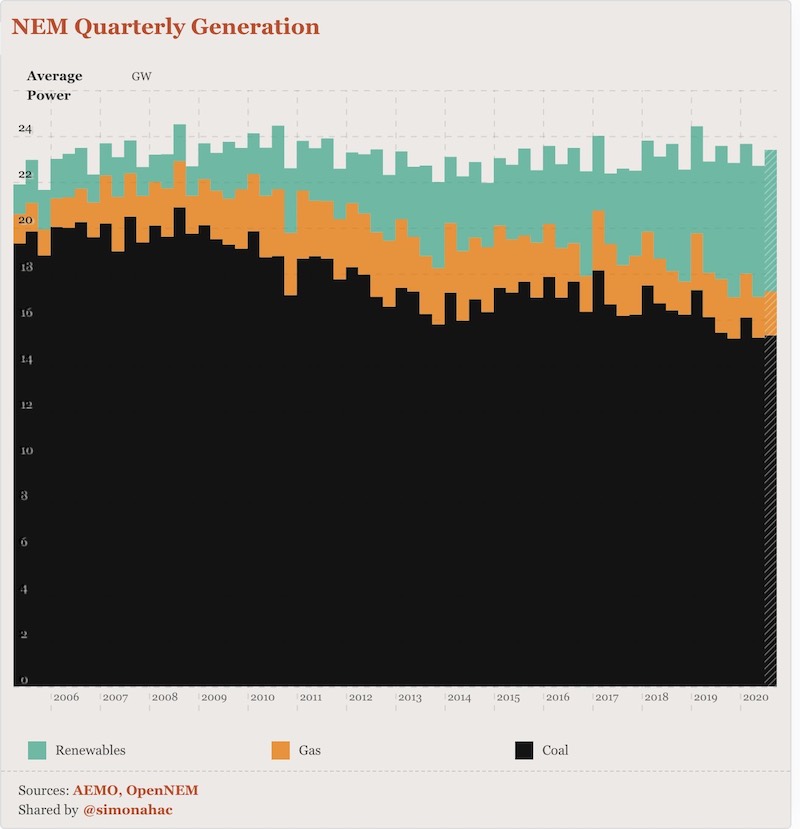

September 2020 has gone down in history as the first month on Australia’s National Electricity Market with a more than 30% share of electricity coming from renewables, according to a series of charts posted on Twitter on Thursday.

https://twitter.com/OpenNem/status/1311 ... l-36129%2F

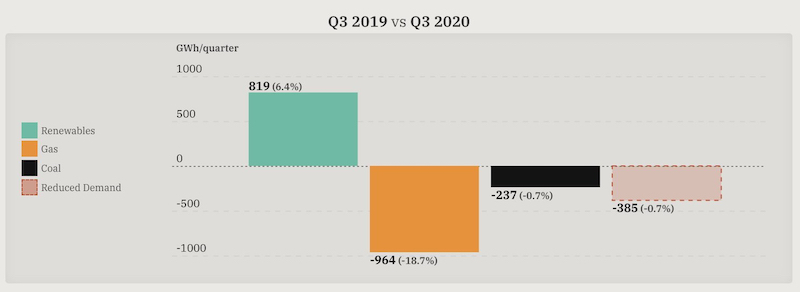

In NEM stats shared here by Windlab’s David Osmond and then re-tweeted with some added detail by energy analyst Simon Holmes à Court, total renewable electricity share reached 30.4% across in September, while both wind and solar notched up new monthly supply records, at 13% and 10.8% respectively.

But while renewables generation increased by 819GWh, or 6.4%, compared with Q3 in 2019, fossil fuels went in the other direction. Coal power generation fell to a new minimum of 10,188GWh and a share of 65.4%. And the Morrison government favourite – gas – was “the biggest loser,” says as Holmes à Court points, “falling a whopping 18.7% to less than five per cent.

“Folks adamantly claiming that ‘more RE = more gas’ should find this embarrassing,” quipped Holmes à Court.

And, just for the record, South Australia recorded a share of wind and solar of 66 per cent of local demand in the month of September, a record. Oh, and the lights stayed on.

See also David Leitch’s latest analysis: Enough new wind and solar locked in to kill three coal generators by 2025

https://reneweconomy.com.au/september-d ... oal-36129/

Re: News & Discussion: Electricity Infrastructure

Is any more wind or solar "locked in " for South Australia? There seem to be lots of proposals and "we intend to...", but which ones are actually going to go ahead? Neoen has two big proposals, Iberdrola has one, there are a few solar proposals around Robertstown and Morgan, solar near Murray Bridge, wind on the eastern side of the Mount Lofty Ranges, .... Will any get built in the next few years? None are listed as "committed" by AEMO.

Re: News & Discussion: Electricity Infrastructure

Here is my take on the current situation......I have no inside knowledge but reading between the lines (of lots of news articles on renewable energy in this country)SBD wrote: ↑Fri Oct 02, 2020 1:32 pmIs any more wind or solar "locked in " for South Australia? There seem to be lots of proposals and "we intend to...", but which ones are actually going to go ahead? Neoen has two big proposals, Iberdrola has one, there are a few solar proposals around Robertstown and Morgan, solar near Murray Bridge, wind on the eastern side of the Mount Lofty Ranges, .... Will any get built in the next few years? None are listed as "committed" by AEMO.

Gupta's Whyalla solar farm - should have been well into construction by now....Covid 19 problems with supply of the panels from China???? I don't know but I would imagine that Gupta has every intention of making this project happen (which will supply his main steel business with incredibly cheap power, as well as selling power to other heavy industries and the grid providing him with a constant cashflow)

Neons Goyder project - Stage 1 has already been committed to proceed and Neon has a contract with the ACT government. This project could be a huge gamechanger for the state if stages 2 and 3 go ahead (subject to the SA-NSW interconnector being built) Neoen seem like pretty serious players and have made lots of money from "le sud d'Australie"

Iberdrola Port Augusta wind and solar farm - these guys are the worlds biggest renewable energy company.

No reason to suggest that this will not proceed (some articles I have read indicate that Iberdrola have already awarded the contract to build the wind farm but the company has officially said nothing)

For the other projects I can say little more than what has been posted in previous news articles.....

And back to an article I posted yesterday claiming that South Australia produced 66% of its electricity from renewables in September...now Renew Economy is claiming the correct number is 73%......the discrepancy being that some power was exported to Victoria and should not be counted towards the SA grid demand.

South Australia wind and solar served stunning 73% of demand in September

The renewable energy records continue to fall, which in Australia must mean that Spring is in the air, because that is the season of usually good wind conditions, strong solar, and relatively low demand due to the mild temperatures.

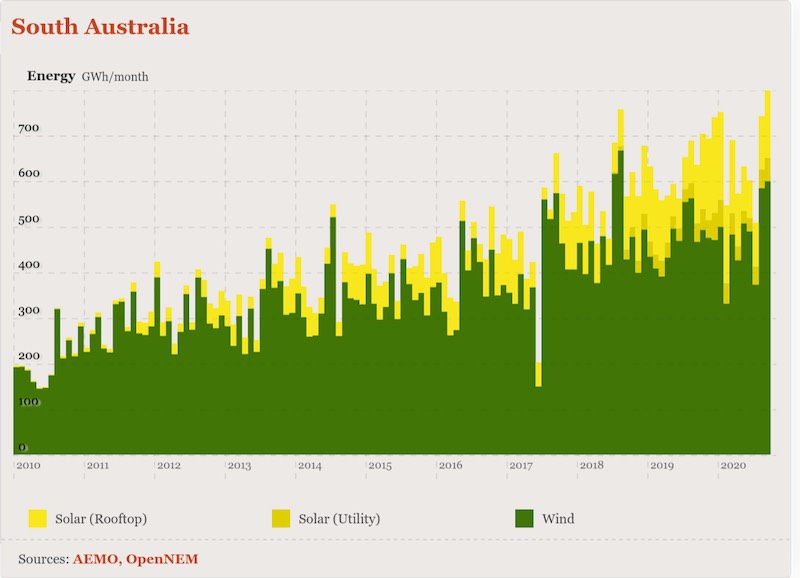

The share of renewables in Australia’s main grid is breaking new records, including an instantaneous 52.5 per cent share reached on Friday, but the more striking achievement came in South Australia, where wind and solar combined to meet 73.3 per cent of local demand in the month of September.

As we reported on Thursday, when noting the record 30 per cent share of renewables in the main grid for the month of September, South Australia’s wind and solar reached 66 per cent of local generation.

But Dylan McConnell, an energy analyst from the Climate and Energy College in Melbourne, points out that South Australia is a net exporter (to Victoria) and the share of wind and solar in South Australia compared to local demand was 73.3 per cent.

Three quarters of the output came from wind farms, with the rest supplied by rooftop solar and the state’s first three large scale solar farms. The share may have been more without various constraints and the decision by some wind and solar farms to switch off to avoid the numerous negative pricing events. The average wholesale price in South Australia over the month was around $14/MWh.

This graph above shows the growth over the last 10 years, and it will continue to grow. remember, the state’s Liberal government has a target of “net 100 per cent renewables” to be reached before 2030, and the Australian Energy Market Operator believes this could happen as early as 2025.

That may depend on whether the proposed new link to NSW, Project EnergyConnect, goes ahead. But there are a huge number of big projects already committed, or in the pipeline, including the first 100MW stage of the Goyder South project, which could grow to a massive renewables hub of 1,200MW of wind, 600MW of solar, and 900MW/1800MWh of battery storage.

As well, the country’s biggest hybrid wind and solar park (330MW) is being built near Port Augusta by DP Energy and Iberdrola, while Nexif is looking to add the second stage of the Lincoln Gap wind farm, and Sanjeev Gupta is about to start construction of a 260MW solar farm.

And there are many others in the pipeline.

https://reneweconomy.com.au/south-austr ... ber-53751/

Re: News & Discussion: Electricity Infrastructure

The proposed SA-NSW interconnector construction's cost has risen although the arguments for its approval still are the same.

From Renew Economy

From Renew Economy

More renewables, less gas: South Australia turns energy debate upside down

Two of the country’s biggest transmission companies have joined forces with the South Australia Liberal government to argue that the prospect of more wind and solar projects, a significant cut to gas fired generation and lower prices will justify the increased costs of the proposed new transmission link to NSW.

Electranet and Transgrid have submitted new documents to the Australian Energy Regulator, outlining the case for the Project EnergyConnect, which would provide a 900km, 800MW link between the renewables dominated South Australia grid and the (for now) coal dominated NSW grid.

The documents show that the anticipated cost of the new link has ballooned from the original estimate of around $1.5 billion to $2.4 billion.

But the two transmission companies say new modelling shows the new link will deliver even greater net market benefits because it would unlock major new wind and solar projects, significantly reduce the need for gas-fired generation, and deliver savings of more than $100 a year to each South Australian household and a total of $180 million a year to NSW households.

It has received the support of the South Australia state government, with energy minister Dan van Holst Pellekaan declaring it would unlock huge projects and ensure the state reaches the Liberal government’s target of net 100 per cent renewables even earlier than planned.

“The inter-connector allows us to reach our net-100% renewables goal sooner, whilst securing our grid and delivering bill relief to South Australians,” van Holst Pellekaan says in a statement.

“The interconnector will create hundreds of jobs, unlock billions of dollars-worth of investment and deliver cleaner, more reliable and more affordable energy for South Australians,” Premier Steven Marshall added.

Among those projects cited by the South Australia government are the “mammoth” $3 billion Goyder South wind, solar and battery project, and the expansion of Lincoln Gap wind and solar project near Port Augusta. There are numerous other projects also in the wings.

The pitch by the South Australian Liberal government is in stark contrast to its federal conservative colleagues, who have focused not on renewables but on a gas-led “transition”. Prime minister Scott Morrison and energy minister Angus Taylor argue that gas power will lower prices and boost reliability.

The South Australia government and the two transmission companies essentially argue the opposite. Indeed, the new modelling for the transmission link, and separate modelling by the Australian Energy Market Operator, reveals the folly of the “gas transition” idea, because both point to gas being further reduced to a very minor role in a grid dominated by renewables.

South Australia, already at more than 57 per cent renewables over the past year, intends to reach “net 100 per cent” renewables within a few years. Gas will be relegated to a very minor role. And on Australia’s grid, AEMO predicts a 94 per cent share for renewables by 2040 in its step change scenario, and a similarly small role for gas.

The huge increase in costs for Project EnergyConnect is attributed to increased costs for poles and wires and associated equipment, but also to changes in the route and access roads to avoid culturally sensitive areas and other issues.

But the two transmission companies say that new modelling by ACIL Allen shows the savings are even bigger than before, thanks to the reduction in wholesale electricity prices (an average fall of $14/MWh) driven by the anticipated increase in wind and solar, and the reduction of gas-fired generation, which will slump from a recent share of more than 40 per cent of South Australia’s electricity needs, to less than 10 per cent.

“Project EnergyConnect will deliver cheaper electricity, more renewable energy and is an important measure to addressing emerging security risks in the network,” ElectraNet CEO Steve Masters says in a statement.

“Since we completed our original analysis on this project, there has been significant changes to the energy market and the cost of transmission across the National Electricity Market (NEM).

“At an updated project cost of $2.4 billion, the cost benefit analysis shows Project EnergyConnect continues to deliver positive net market benefits and remains the preferred option to satisfy the requirements of the AER. More renewable energy will be unlocked as result of the project, resulting in further downward pressure on prices.”

Transgrid says the new link will allow “the free flow of electricity between NSW and SA for the first time in Australia’s history”, and plug a gap in Australia’s energy system.

“EnergyConnect will lower NSW electricity bills by increasing competition in the wholesale electricity market and it will also create a more secure system that is resilient at times of high demand and in periods of extreme weather,” CEO Paul Italiano says in a statement.

And it promises more than just the $180 million in savings for NSW households.

It says it will create 1,500 jobs, inject more than $4 billion into the economy, and deliver benefits beyond those normally analysed by regulators, including $6.8 billion to $14.7 billion of long term benefits that would accrue after the end of the regulatory consideration and additional “non monetised” benefits such as renewables integration and system security, such as the benefits to proposed renewable energy zones.

Still, the project is no sure thing. It faces delays and scrutiny as it works its way through the laborious regulatory regime in Australia. To further complicate matters, Transgrid – in an effort to cushion the significant rise in costs on its side of the project (from $1.2 billion to more than $1.9 billion) – is asking for a rule change that will allow it to fast-track revenues so it can defray the costs of financing.

That procedure requires approval of the Australian Energy Market Commission, while the AER will work through the final documents filed by the two transmission network operators, known as their Contingent Project Applications.

The project comprises of a new 330-kV electricity inter-connector between Robertstown in South Australia, and Wagga Wagga in New South Wales, and a short 220-kV spur from Buronga, in New South Wales, to Red Cliffs in northwest Victoria. It is designed to unlock renewable energy projects in South Australia, NSW and potentially Victoria, and is a key component of AEMO’s 20-year blueprint, the Integrated System Plan.

https://reneweconomy.com.au/more-renewa ... own-54916/

Re: News & Discussion: Electricity Infrastructure

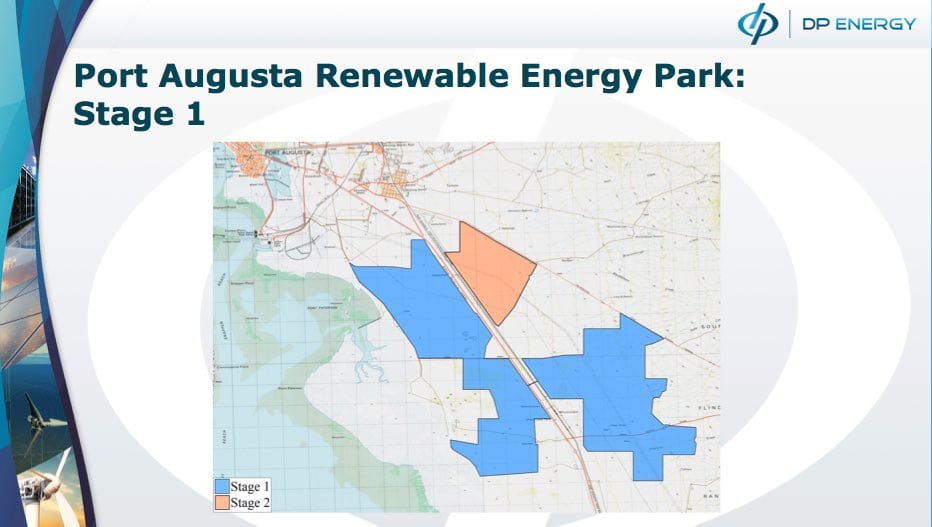

Iberdrola have started building their solar/wind farm near Port Augusta.

From Renew Economy

From Renew Economy

Iberdrola begins construction of Australia’s biggest hybrid wind and solar farm

The Spanish energy giant Iberdrola has announced construction has begun of its 317MW hybrid wind and solar farm near Port Augusta, the company’s first greenfields project in Australia, and the largest wind and solar hybrid project in the country.

The $500 million Port Augusta Renewable Energy Project – featuring 207MW of wind generation and 110MW of solar – is located near the former site of South Australia’s last coal-fired power station, along with the 220MW Bungala solar farm and the 214MW Lincoln Gap wind and battery projects that have helped replace it.

It is also located in the heart of the electorate of state energy minister Dan van Holst Pellekaan, who wants the state to reach its target of “net 100 per cent renewables” by 2030, a target that will be accelerated if the proposed new link to NSW, Project EnergyConnect, is built as planned.

“We have seen quick progress in challenging times, so it is great to have spades in the ground already on our first ever project in Australia,” Iberdrola country manager Fernando Santamaria said in a statement.

“Port Augusta is a major commitment in terms of investment and clean energy capacity, both for the Australian renewables market and for Iberdrola’s global project portfolio.”

Iberdrola is a global company of significant scale, with a market value of more than $A100 billion, and is one of a number of multi-nationals building large scale renewables in Australia, along with the likes of Enel Green Power, Total Eren, BP, and Shell.

Iberdrola is also completing its purchase of the listed renewable energy company Infigen, which will give it an operating portfolio in Australia of more than 800MW – mostly wind and the Lake Bonney big battery – and a development pipeline of more than 1,000MW.

“The Australian renewables sector as a whole offers great potential and, as a long-term operator, this flagship project highlights our commitment to invest in countries where we see good conditions for clean energy to grow,” Santamaria said.

The event was due to be attended by both van Holst Pellekaan and state Liberal premier Steven Marshall, who also noted that Singapore-based Nexif has just begun construction of the 86MW second stage of the Lincoln Gap wind project, which will eventually grow to 364MW.

“These projects provide a critical boost to South Australia’s post-Covid economic recovery, and are encouraged by the SA-NSW interconnector which provides them with new export opportunities,” Marshall said in prepared comments.

Van Holst Pellekaan said Port Augusta will showcase a new generation of renewables designed to provide predictable power more uniformly across the day.

“The project’s combined solar and wind generation output is expected to closely match South Australia’s electricity demand profile which will help place downwards pressure on electricity prices while also assisting with the security and reliability of the grid,” he said.

“These regional renewable energy projects are an example of how the State Government is delivering on its vision for South Australia to achieve 100% net renewable energy by 2030.”

The enthusiasm, and attendance, of the South Australia Liberal government is in stark contrast to the federal government, which despite boasting about the amount of renewables built in Australia over the last couple of years – from a policy that it had tried to kill – has not sent any Coalition prime minister or energy minister to visit a wind or solar farm in the seven years it has been in office.

Current energy minister Angus Taylor didn’t even make it to the opening of a major wind farm, Crookwell 2, in his own electorate, which is not surprising given his long track record of opposing wind developments.

Iberdrola says around 200 jobs will be supported during construction of the Port Augusta project, with 20 full-time jobs based on-site once construction is completed in 2021. It will generate enough clean energy to power the equivalent of 180,000 Australian homes.

“The South Australian Government has worked closely with us during the construction planning, and we were happy to be able to show the Premier and Energy Minister the progress at the site today,” Santamaria said. “The project is delivering jobs and significant economic value for the local region.”

Iberdrola bought the project from DP Energy, which has been working on developing the project for years, and will remain involved until completion. The two main suppliers for the Port Augusta project are Vestas, which will install 50 wind turbines with a 4.2 MW capacity, and Longi, which will deliver nearly 250,000 solar PV panels.

Elecnor will construct the storage areas and access roads, as well as delivering the export transmission line, the substation and wind farm Balance of Plant. India’s Sterling & Wilson will construct the solar farm.

https://reneweconomy.com.au/iberdrola-b ... arm-55008/

Re: News & Discussion: Electricity Infrastructure

Continue to be surprised and impressed by our state Liberal government being so much better on energy than their federal colleagues.

Re: News & Discussion: Electricity Infrastructure

Mass Solar panel frames are being instead at Lonsdale.

Visible from Christie Road/Chrysler Road.

Likely SAWater build?

Visible from Christie Road/Chrysler Road.

Likely SAWater build?

Re: News & Discussion: Electricity Infrastructure

Sounds like the ones they announced they're putting in at the desal plant

Who is online

Users browsing this forum: No registered users and 2 guests