South Australia enjoyed 82 pct wind and solar for entire December quarter. So it can be done

South Australia reached a record average of 82 per cent renewables in the December quarter, establishing a stunning blueprint for the way the entire Australia grid could reach the federal government’s current national target for 2030.

What’s remarkable about South Australia’s new landmark is that its renewables share is made up entirely of wind and solar – the variable or intermittent sources that were supposedly going to send us back to the Dark Ages – and with relatively little storage.

The state stands as a shining de-bunk to all the shocking myths and misinformation against renewables (and EVs) being peddled with increasing intensity around Australia and the world by vested interests and a compliant media.

Data from the newly upgraded OpenNEM data source shows that wind energy dominated the power mix in the December quarter in South Australia, meeting 47.3 per cent of demand.

Rooftop solar came next with 27.9 per cent, and on occasions accounted for all the state’s demand in a quite extraordinary and world-leading outcome, while utility scale solar (often curtailed thanks to the daytime dominance of rooftop solar) accounted for 6.7 per cent.

Gas is the only remaining fossil fuel on the South Australia grid – the last coal generator was shut down in 2016 – and accounted for most of the rest. Imports (325 gigawatt hours, or 9.6 per cent of demand) slightly beat exports (254 GWh) but not by much.

What’s interesting about this outcome is that South Australia has had little in the way of storage to date.

Yes, it had the first large scale battery in the world – the Tesla big battery at Hornsdale (now sized at 150 MW and 193 MWh), and the first big batteries with grid-forming inverters, which will allow them to duplicate most, if not all, the grid services of synchronous generators.

But there are just a few big batteries currently operation on the S.A. grid – Hornsdale, Dalrymple North, Lake Bonney and the new Torrens Island big batteries.

It means that they only account for 0.8 per cent of total generation in the last quarter, although it is interesting to note that on occasions – when wind and solar provide more than the state needs and it is exporting to Victoria – battery storage has actually overtaken the output from gas generators.

There is a reason for this, and that’s because the role of most of these batteries has been focused on the provision of grid services – network support and frequency control – which only require small amounts of storage.

Actually storing wind and solar for times of low supply and/or high demand requires more storage hours, and is only now being rolled out at scale.

The achievements of South Australia are remarkable in the context of what was thought to have been understood about the grid: You don’t have to go back too far to hear strident assertions that a modern grid could barely operate with more than 10 per cent renewables. Sadly, variations of those views still reverberate around Australia’s conservative political circles.

We were also told – as recently as 2016, by none other than the market operator – that large scale battery storage was not on the horizon (the Tesla big battery was built just over a year later), and that all wind and solar needed like for like back-up or storage.

What South Australia shows is that – as some studies suggested – little new storage is needed in a grid up to around 50 per cent renewables, and then only incrementally until it gets to very high levels – 80 to 90 per cent.

The reason for this is that modern grids have connections to other grids (South Australia’s is to Victoria, and soon to NSW), and that there was already a lot of back-up installed for a fossil fuel grid, in the form of peaking and other plants.

These back-ups were built to support and balance the so-called “baseload” coal and gas plants that lacked flexibility to respond to changes and peaks in demand, and occasionally broke down or needed maintenance. The idea that baseload coal or nuclear does not need back-up is one of the great furphies of the modern energy debate.

What is also interesting about South Australia is that the level of renewables is now getting to the point where that traditional fossil fuel back-up is no longer fit for purpose, and/or is getting old. And they will no longer be needed for so-called “grid services such as frequency and inertia because battery and inverter technologies can do the job.

So as South Australia charges along to its target of “net” 100 per cent renewables and beyond (to cater for exports and green industries) it is building more batteries, with the new link to NSW that will allow out to export and import more.

The new 250 MW, one hour Torrens Island battery has been recently added and could be expanded to up to four hours storage, the Blyth battery is being built, with one of its major roles being to help deliver a “baseload” renewables supply to the massive Olympic Dam, and the Tailem Bend solar battery is also awaiting commissioning.

EnergyAustralia has announced plans for the state’s first four hour battery at Hallett, and other batteries are planned by Zen Energy at Templers, AMP Energy at Bungama, Equis at Koolunga, CIP at Summerfield and Lionsgate, Origin Energy at Morgans, and Neoen at Goyder.

Those batteries will help fill the gaps in generation on a daily or multiple day basis, but the bigger challenge, however, will be in long duration storage – defined as eight hours storage or more – that will fill in longer gaps in wind and solar supply.

And if South Australia wants to go further than “net” 100 per cent renewables, and reach “real” 100 per cent renewables, then the scale of storage required will be significantly higher (more on that another time from a report by the Victoria Energy Policy Centre).

here are a couple of other things to note as well. One is that emissions in South Australia have fallen significantly, from an average of nearly 800 kg of Co2 per megawatt hour in 2010 to 195kgCo2e per MWh so far this year. And the second is that wholesale prices in South Australia are the second lowest on the mainland.

They will be lower still, as more gas is replaced by storage, and should soon be reflected in lower customer bills, even though the bulk of that is made up by the costs of the grid in South Australia, which have been historically high because of the relatively small population in a big state.

The question for many is what will 82 per cent renewables look like for Australia as a whole. It will be slightly different to South Australia, mainly because other states have hydro and pumped hydro, both existing and under construction, and will likely have some other forms of long duration storage.

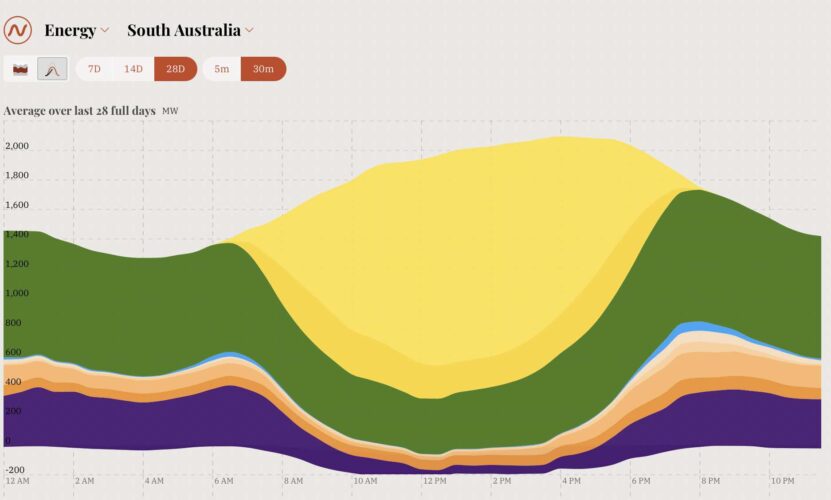

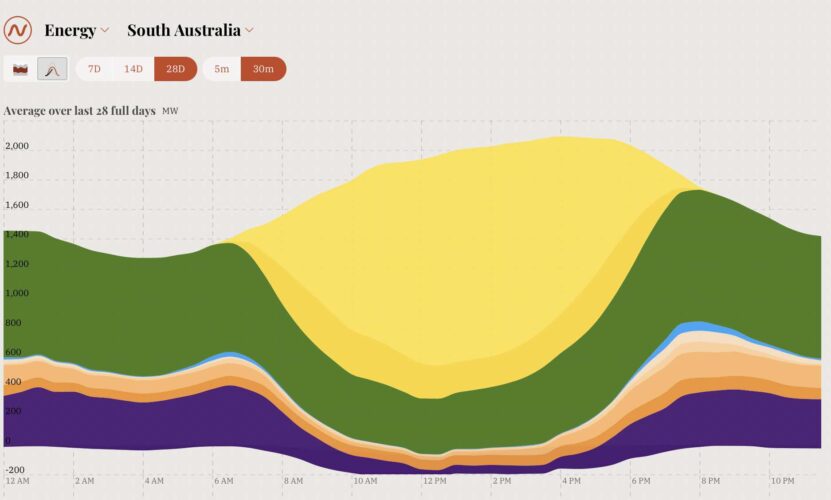

But the principal will be the same as the graph above, which shows the latest 28-day average of South Australia (average 78 per cent), with most of the daytime load serviced by solar – rooftop and utility scale, supported by wind and storage if needed.

The difference with the whole national grid is that there will not be an opportunity to import from another source.

States will share energy through transmission lines, but the gaps will need to be met through storage and demand management, which in itself is a whole new ball game about the timing of the use of industrial process, such as green hydrogen and manufacturing, EV charging and the whole switch to Everything Electric.

That will require another step change in thinking about what is possible about the grid. But it is entirely doable. And, as all the experts say, will be cheaper and cleaner, and more reliable.

https://reneweconomy.com.au/south-austr ... n-be-done/