Page 84 of 93

Re: #Official Mining Thread

Posted: Thu Aug 23, 2012 3:34 pm

by rhino

Tony Abbott wrote:

Leigh, I didn't say that the carbon tax and the mining tax were solely to blame

Waewick wrote:he hardly blamed them - but pointed out it is harder to do business here...which it is (just ask business people)

Re: #Official Mining Thread

Posted: Thu Aug 23, 2012 5:05 pm

by PeFe

Now that the dust has settled (sorry,couldn't resist it) its time to work out what will happen next. Marius Kloeppers will meet Jay Weatherill sometime late this year, no doubt with a plan B for the Roxy Downs mine expansion. BHP-Biliton have a capital expenditure ban in place till after June 2013 so any future expansion will not start work till probably 2014 (?) at the earliest. My prediction is a scaled down Roxby expansion maybe between 5-10 billion dollars, after all according to media reports there is 1 triilion dollars worth of minerals still left in the ground and I am sure BHP-Biliton do not want to miss out on that bonanza.

Re: #Official Mining Thread

Posted: Fri Aug 24, 2012 5:32 pm

by skyliner

Pe Fe - I have come to similar conclusions - especially after 2 news reports here in Brisbane about it all being 'on hold' - suggests something is still going on but later on.

SA - Great State

Re: #Official Mining Thread

Posted: Sat Aug 25, 2012 3:46 pm

by Wayno

An outstanding item of confusion is why BHP snapped up a vast area of tenements around ODX in the last 12 months. They purchased exploration licenses for 22,000sq/km of land (10x their previous holding) costing approx $25m.

I'm thinking it's probably a combination blocking strategy (stop other companies edging in on the game) and cherry picking strategy (as the 22,000sq/km could contain several gold/copper deposits just below the surface - easy & cheap to access). I don't like the idea of 'land banking' and I hope the SA govt chooses to do something about it (e.g. penalty costs for not developing in a given time frame).

Re. ODX itself we can but for more news to be released. I believe Kloppers pulled the plug last week to allow time for re-negotiations with the SA Govt prior to the mid-december expiry.

Re: #Official Mining Thread

Posted: Wed Aug 29, 2012 1:01 pm

by Ben

From InDaily

Olympic Dam still a goer: govt official

Wednesday, 29 August 2012

Liam Mannix

STATE Government officials still hold out hope for a modified expansion of BHP’s Olympic Dam mine.

Citing the cost of re-starting the Environmental Impact Asessement process, Olympic Dam Taskforce chief executive Paul Heithersay yesterday told a conference in Adelaide he thought BHP would begin work on a limited expansion in the next two or three years.

Heithersay told the SA Major Projects Conference at the Adelaide Convention Centre the current large and expensive Environmental Impact Statement expires in 2016.

“They (BHP) have to have started substantial work by 2016 or they have to go back to the federal minister for approval,” he said.

“And that would be a very expensive and difficult thing to do so it’s in BHP’s interests and they are very keen to try and achieve this new, less capital intensive program by that time.

“So what are we looking at? It might be a two, three-year delay potentially but there’s no doubt in my mind of the commitment that BHP and the state have got to unlocking the value of this ore body.

“Mining is a long-term game – it’s a 10 year game from discovery to development.

“So the sort of two and three year timeframes we’re talking about for Olympic Dam are, within context, not unreasonable things to deal with.”

Last Wednesday BHP announced it would not proceed with the planned expansion, preferring to re-assess the project’s cost and technical processes.

It brought a sudden halt to expectations that works would start by the end of this year – the deadline imposed by the State Government’s legislated Indenture Agreement that sets the regulatory framework for the project.

The agreement required works to start by mid-December this year.

Federal environmental approvals have a longer timeframe.

In October last year the Federal Government (along with State Government agencies) approved BHP’s Environmental Impact Statement for the Olympic Dam expansion.

“If at any time after five years from the date of this approval, the approval holder has not substantially commenced the activities covered by this schedule, then the approval holder must not commence those activities without the written agreement of the minister,” the Federal Government’s approval for the EIS stipulates.

The EIS examined the potential environmental, social, cultural and economic outcomes and impacts of the expansion and how BHP planned to managed those impacts.

BHP said in last week’s announcement it would seek less capital-intensive designs for the expansion which would involve new technologies.

One of those proposed technologies is heap leaching, which Heithersay said was “showing a huge amount of promise”.

“It’s a much cheaper way of processing, it means they don’t have to build a number of smelters and extend the processing plants as they were expecting to, so there’s a big capital saving there.

“It’s a very exciting breakthrough technology and if it can work at scale, which is really the question now, then potentially they’ll be able to mine actually lower grade ore and increase the size of the ore body.”

A 2009 report by BHP on alternatives to the Olympic Dam expansion project said heap leaching wasn’t yet producing the results required.

“The feasibility of leaching of the lower-grade ore at Olympic Dam is under investigation,” the report read.

“At this early stage, recoveries of copper and uranium from heap leaching appear too low, but the option continues to be investigated.”

Re: #Official Mining Thread

Posted: Mon Sep 03, 2012 9:53 am

by Benski81

In light of the cancellation of Olympic Dam, I thought that this was worth sharing, it's from Shane Oliver who's the head economist for AMP capital (sorry about the branding). I like that he's done this one as there's a bit of talk in the media about the end of the mining boom.

Re: #Official Mining Thread

Posted: Mon Sep 03, 2012 6:39 pm

by Will

The news just keeps getting worse regarding Olympic Dam. Now it seems, that not even a dumbed down expansion may eventuate at all.

Premier Jay Weatherill says BHP Billiton's Olympic Dam expansion even further away than first thought

Political Reporter Lauren Novak

AdelaideNow

September 03, 20123:35PM

BHP Billiton boss Marius Kloppers has given no guarantees on when or how the company intends to expand the Olympic Dam mine in future.

After a meeting with Mr Kloppers in Adelaide this afternoon, Premier Jay Weatherill said he now believed any future expansion of the outback mine was further away than first thought.

BHP has said it is exploring cheaper ways to extract the mine's ore and new technologies to process it.

Mr Weatherill said Mr Kloppers was today not able to say when the technology would be ready or if it would work and so could not "give us certainty about when the mine proceeds".

"That is information that I think will be concerning to the South Australian community," Mr Weatherill said.

"It is their (BHP's) intention to pursue the expansion but only when those (new) technologies are proven up. Of course, they may never be proven up."

Mr Weatherill said he made clear to Mr Kloppers the "disappointment" of South Australians at the announcement on August 22 that the expansion would be shelved.

"Mr Kloppers understood that this was a deeply disappointing decision," he said.

Mr Kloppers told reporters he had made South Australia his first stop back in Australia after BHP Billiton's results presentation in the UK.

It's his first visit to Australia since the mining giant decided to shelve its $30 billion expansion at Olympic Dam.

He did not ask for an extension to the existing indenture agreement with the State Government, which is due to expire on December 15.

Any future mine expansion plan will need to be renegotiated - including the generous 45-year deal on royalties.

He repeated that there was no guarantee that the Olympic Dam project would eventually proceed because it was never finally approved by the BHP board.

"However, it remains a fantastic copper deposit and BHP is working on its alternative mining technologies," he said

Re: #Official Mining Thread

Posted: Tue Sep 04, 2012 7:20 am

by Wayno

Below are some cautiously optimistic words from Kloppers. Basically a catch 22 situation right now. BHP can't walk away as the ODX lode is too good to ignore, but the cost of extraction (using a traditional dig it up and smelter approach) is too high. So they are examining alternate extraction methods. The game changer is how soon they can develop & refine the 'heap leaching' process. Similar is being used in Chile, although the process needed for ODX differs somehow.

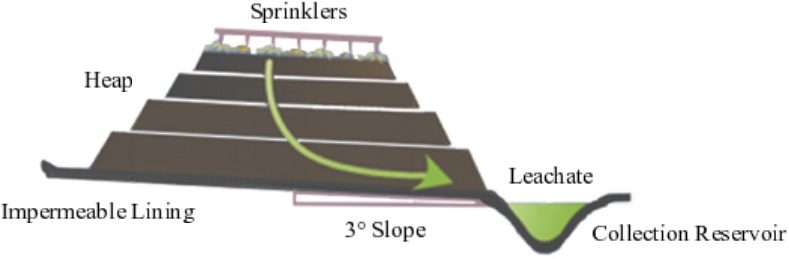

Here's how heap leaching works (dig up the dirt, stacks in mounds, poor through acid, collect in a pond, send for processing)

- heap-leach.jpg (33.3 KiB) Viewed 4063 times

From AdelaideNow

BHP Billiton chief executive Marius Kloppers has reassured South Australians the company is not walking away from the Olympic Dam mine project.

"The company is going to work with undiminished vigour on bringing this magnificent ore body into production," he said yesterday.

In an extended interview with The Advertiser, he emphasised that the plans drawn up for expanding the copper, uranium and gold mine had stumbled because of high capital costs and the company had to step back and work on alternative mining and processing methods to make it viable.

Mr Kloppers was speaking after his first meeting with Premier Jay Weatherill since BHP announced on August 22 that it would defer the mine expansion.

Returning from a world tour after announcing BHP's 2011-12 results, Mr Kloppers said his priority on return to Australia had been to brief the State Government on continuing work at Olympic Dam.

"The SA team, under Dean Dalla Valle, have two or three things in particular they are very enthusiastic about as offering the potential to both decrease operating costs and increase efficiency," he said.

These included extracting minerals by leaching, a process used at BHP Billiton mines in Chile.

Mr Kloppers said he had not asked the Premier for anything in their meeting. "It really was to talk about what we will continue to do," Mr Kloppers said. "What we had been engineering became unviable because of the capital costs."

Mr Weatherill said the Government was "given a very clear set of information from Mr Kloppers that he cannot guarantee either a timeline or a process that is going to lead to the expansion of this mine".

Olympic Dam expansion interactive

Asked whether he would grant an extension to the December 15 deadline on the agreement governing the expansion if BHP came to him at the last minute, Mr Weatherill said, "no."

Mr Kloppers said while he could not guarantee the mine expansion would proceed, the company would work "unbelievably hard" to pursue options to recast the economics more favourably.

"One of the things that has been difficult, is that people take everything we work on as being approved," he said. "Then when we are unable to make it work they feel we've unapproved it."

Asked whether South Australians, in the words of Mr Weatherill, should be "wary" of BHP because it had not gone through with the project, Mr Kloppers said the company had repeatedly noted the final decision was the board's.

"It's a very tough thing to make disclosures - particularly to the media - before a decision is made," he said.

"The continuous disclosure issues (which govern share trading) simply make it impossible to disclose something until a decision is taken. That's the world we live in."

"People are only now coming to grips with the fact that commodities demand is down, prices for some commodities have halved over the last nine months or so," Mr Kloppers said. "When that happens, it has to have an impact on the viability of investing money."

He said Olympic Dam still potentially fitted perfectly into BHP's strategy of being diversified by commodity, market and geography.

"There is only one issue - the project that we had been engineering became unviable because of the costs," he said. "Unfortunately, it is impossible to go forward if you know that it is not viable any more.

He said BHP's challenge was to find ways and technologies to reduce the capital needed "to unlock this ore body". "It is a large ore body, though not without complexity. It does tick all of the boxes in our strategy statement."

Re: #Official Mining Thread

Posted: Tue Sep 04, 2012 2:21 pm

by Reb-L

I just wonder why BHP is buying up exploration rights for so much land around Olympic Dam if they think it's too expensive to develop. And why today's metal prices would have such impact on the market 5-10 years away which was when the expansion was projected to come on stream (BHP have stressed time and again that this is a long term business). Can't help but to think that the company is building up a resource bank to be exploited/sold much later when prices are heading north again. If that's the case it's unfortunate for SA as it'll prevent other mining companies - with less deep pockets but more willing to take risks - from exploring the area. Maybe somebody has more educated guesses on this?

Re: #Official Mining Thread

Posted: Tue Sep 04, 2012 2:46 pm

by Wayno

Reb-L wrote:I just wonder why BHP is buying up exploration rights for so much land around Olympic Dam if they think it's too expensive to develop. And why today's metal prices would have such impact on the market 5-10 years away which was when the expansion was projected to come on stream (BHP have stressed time and again that this is a long term business). Can't help but to think that the company is building up a resource bank to be exploited/sold much later when prices are heading north again. If that's the case it's unfortunate for SA as it'll prevent other mining companies - with less deep pockets but more willing to take risks - from exploring the area. Maybe somebody has more educated guesses on this?

yep i had the same concern back

here. Tenement Parking is not something i agree with, and it happens frequently in QLD & WA. Can't help that feel BHP are doing similar here in SA.

Re: #Official Mining Thread

Posted: Mon Sep 10, 2012 2:37 pm

by Ben

BHP terminates contract with Tasman to buy exploration tenements near Olympic Dam

From: The Advertiser

September 10, 2012 1:12PM

OLYMPIC Dam owner BHP Billiton has terminated one of its recent contracts to buy a group of exploration tenements near the copper-uranium mine in South Australia.

Tasman Resources informed shareholders it received notice from BHP terminating its two conditional contracts to acquire six exploration tenements in the Stuart Shelf region of South Australia.

The contracts for the five exploration licences and one licence application were announced in June this year and valued at about $3 million.

It followed BHP's earlier spending spree in April of permits from Minotaur for $10 million and Archer for $8 million - all in the vicinity of Olympic Dam.

At the time, a BHP spokeswoman had said the Tasman purchase was part of the miner's long-term strategy.

BHP Billiton shelved its $30 billion Olympic Dam expansion plan on August 23.

Re: #Official Mining Thread

Posted: Thu Sep 20, 2012 11:13 am

by Wayno

A modest sized mine, with quick ramp up time. 10 year duration. I believe it will produce approx 2 millions tonnes of iron ore a year.

New technology has allowed an old iron ore mine in South Australia's mid-north to be reopened.

Mineral Resources and Energy Minister Tom Koutsantonis said Arrium Mining's Iron Baron iron ore mine near Whyalla would create 100 new jobs and also provide a boost to local suppliers.

"New technology has provided an opportunity to review the iron ore assets that were originally worked last century and adopt more efficient practices to extract the hematite," Mr Koutsantonis said in a statement on Wednesday.

"Reworking an old mine in a new century delivers a number of environmental positives.

"For example, tailings will be put into existing pits to minimise the environmental footprint and plans are in place to rehabilitate the mine landscape."

At full capacity the Iron Baron mine is expected to produce about two million tonnes of ore each year.

Arrium Mining chief executive Greg Waters said the reopened mine was part of a $400 million program to extend the life of the company's iron ore reserves for at least the next 10 years.

Re: #Official Mining Thread

Posted: Thu Sep 20, 2012 1:33 pm

by Aidan

That's a big surprise, because Iron Baron hasn't been closed that long. What new technology has emerged in the past two decades to make it viable again?

Re: #Official Mining Thread

Posted: Thu Sep 20, 2012 2:18 pm

by Wayno

Aidan wrote:That's a big surprise, because Iron Baron hasn't been closed that long. What new technology has emerged in the past two decades to make it viable again?

There's been various small step advances in iron beneficiation technology (which basically means extracting iron from the raw dirt). I'm not sure which they intend to use, possible magnetics or liquid separation. It's a bit beyond my knowledge but magnetics basically pulls the iron/nickel dust from the raw material, and liquid separation works on the basis of iron being dense which settles at the bottom of the liquid. Pre-processing the raw material, and use of chemicals & temperature can also increase the yield.

Re: #Official Mining Thread

Posted: Mon Sep 24, 2012 1:06 pm

by Ben

Currently based in Victoria.

Rex Minerals' head office moves to Adelaide by: Cameron England

From: The Advertiser

A new mining company head office will be set up in Adelaide, with Rex Minerals deciding to move its base here.

Rex has also appointed former OneSteel executive Mark Parry as managing director to drive the development of the company's Hillside copper project on the Yorke Peninsula.

Founding managing director Steven Olsen will stay on the board as a director and will continue in a business development role until at least the middle of next year.

Mr Parry has 27 years' experience in the mining and construction sector, and oversaw the development of OneSteel's Project Magnet in Whyalla, which converted the blast furnace to a magnetite feed and boosted iron ore exports.

"This $400 million-plus project involved the development of a large magnetite deposit including new crushing and screening facilities, a concentrator and conversion of the pellet plant and blast furnace to magnetite based feed," the company said.

"In conjunction with this was the development of mining, infrastructure and supply chain to support an

increase in hematite iron ore exports from 1 million tones per annum to 6 mtpa to deliver ore to China."

Rex chairman Paul Chapman said the appointment was a key step for the company.

"Mr Parry's impressive experience as an operator in South Australia was an important influence on the board's decision," he said.

"We are very fortunate to have such a high calibre candidate join the company at a time when key decisions in regard to the development of the Hillside project are being made."

Mr Parry is based in Adelaide and Rex will make the transition to have its corporate office in Adelaide before the start of construction of the Hillside project.