The article is quite technical I wish the author had explained the arguments in laymans terms.

He specifically looks at South Australia at the end of the article.

Let’s talk about battery storage, and why it’s so much easier than pumped hydro

Despite all the talk about pumped hydro in Australia and the need for deep storage, and despite the apparent advantages of flow batteries, what the market is actually opting for is lithium batteries of one flavour or another.

That’s true in Australia at least in the private sector – and if you aren’t one of the federal government’s “captain’s pick” – and it’s true globally.

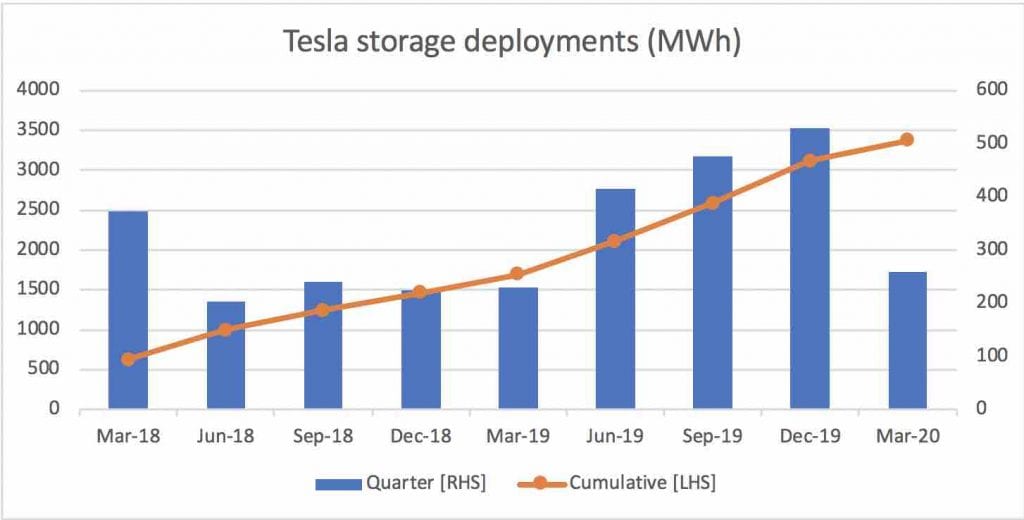

For one data point let’s look at Tesla quarterly shipments. Tesla is now presenting its data in a way that is almost professional.

Cumulative deployments are 3.5GWh and Tesla remains, apparently capacity constrained.,

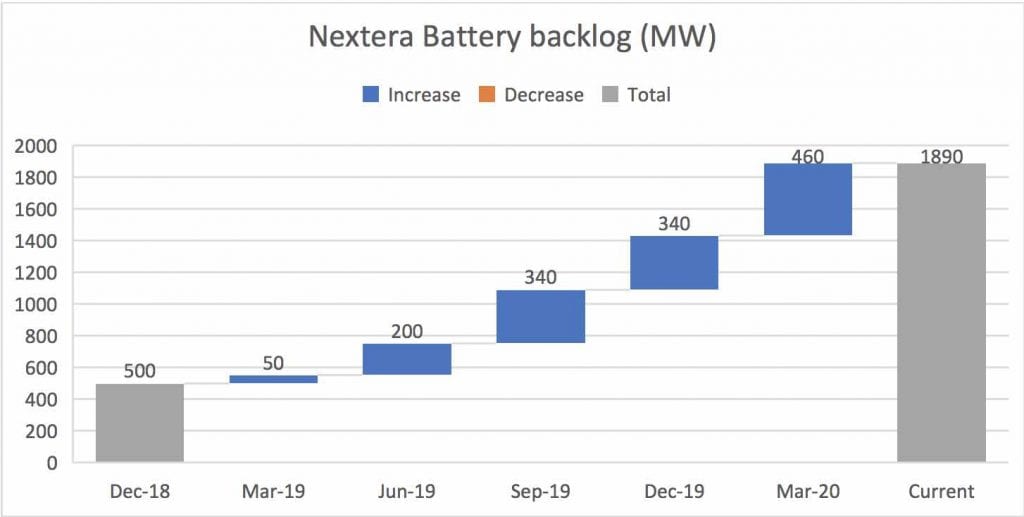

Alternatively the US based NextEra Energy (the world’s best utility in my opinion) shows its battery backlog of committed orders has grown four times in two years. Note this data is in MW, of interest to me is that a significant portion of the backlog is of 4-hour duration.

NextEra states it expects US billion of business in 2021 from battery installations.

So we can’t add Tesla and NextEra due to overlap. Tesla’s order book is global and NextEra’s is confined to the US.

A digression to residential, via SolarEdge

Another company, in ITK’s view, to keep an eye on is SolarEdge, which only started in 2006 but is now the world’s No 1 inverter company. SolarEdge could grow so much because in truth it’s a small market.

You get to be No 1 globally with only $US1.4 billion of annual revenue. Of course, if the China market came back Huawei would shoot up the rankings again.

And SolarEdge isn’t even in the utility inverter market or yet in the battery market, but it’s coming. In 2018 it bought Kokam, a South Korean battery pack and cell manufacturer, and is in the process of expanding Kokam’s factory, but SolarEdge isn’t waiting for that. Its sourcing its storage offerings from outside the company.

In a recent conference call the SolarEdge CFO stated he expects in a few years that basically every residential solar unit will come with storage.

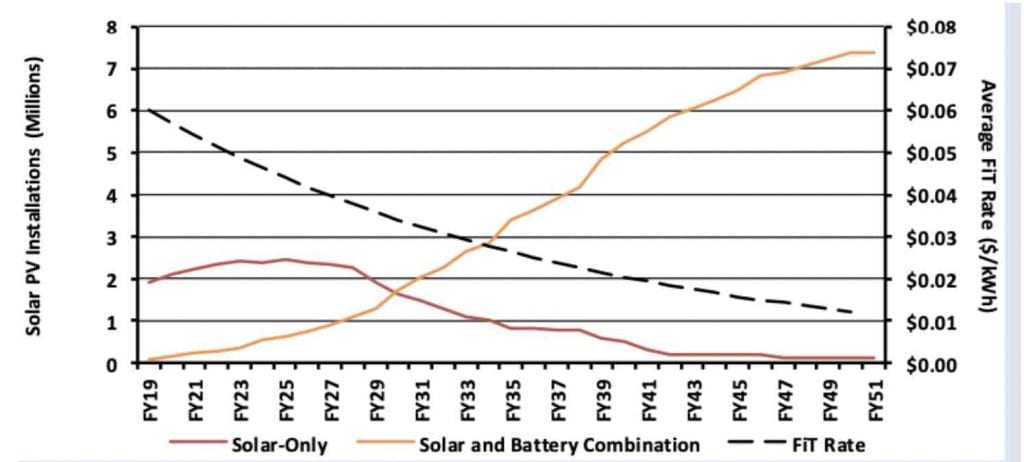

Residential storage is not really the focus of this note, but I can’t move on without mentioning Energeia’s forecasts of the residential market in Australia.

AEMO basically ignored these numbers, as far as I can work out, even though they commissioned them, when they prepared the Integrated System Plan.

Energeia used “agent based” modelling to derive their forecasts, which sounds fancy. But in this case what it boils down to is that more and more households will install batteries because (i) battery costs will fall and (ii) feed-in tariffs will also fall. As a result, the ROI (return on investment) on a battery will increase.

So every year a bigger portion of new rooftop solar installs will have batteries.

You can also have an interesting discussion about use of household, or community batteries in terms of controlling the grid.

In my view, batteries are el primo when it comes to grid control, but the software to run the entire system rather than just isolated collections of assets is still a good way off.

Figure 4 Source: Energeia 2019, NEM solar and battery residential systems

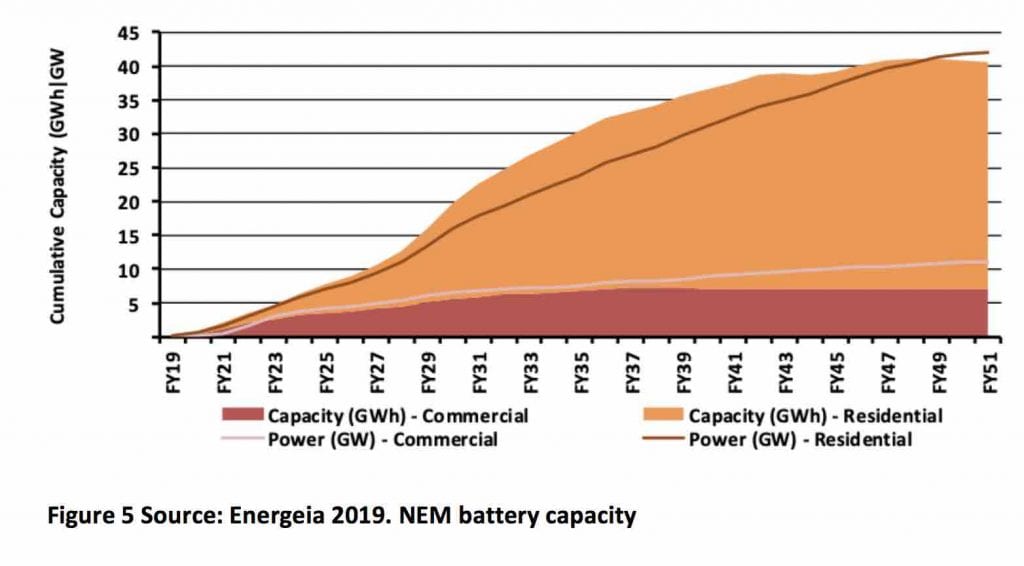

Figure 5 Source: Energeia 2019. NEM battery capacity

What’s driving batteries over pumped hydro?

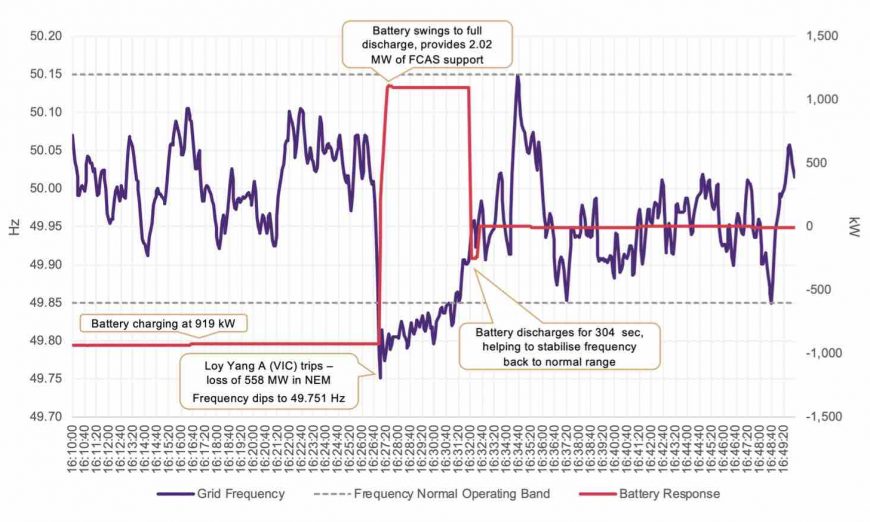

The short answer is that batteries are wonderful at FCAS (frequency control and ancillary services). Equally, batteries are really easy to do if the economics are supportive, but pumped hydro is incredibly difficult to do.

For a battery, you order it, you jump through a few antiquated regulations, you find a spare bit of land and 3-6 months later, certainly less than a year, you are up and running.

For pumped hydro, unless you are in the middle of the Queensland outback you can expect to have years of environmental and geology discussions. Literally years. It almost reminds me of the Monty Python skit about how tough it was in Yorkshire.

Getting your transmission inter-connector through the cold dead hands of the RIT-T (regulatory investment test) and its proponents is child’s play compared to getting your pumped hydro project up in someone’s favourite wilderness spot.

Then, of course, battery prices are coming down. I don’t usually do this but I’ve removed the numbers and axis from ITK’s forecasts so I suppose they aren’t much use.

Figure 6 Battery costs for various durations. Source: ITK

The forecasts are based on a standard learning rate function using industry estimates of global battery volume growth.

The learning rate estimates the reduction in unit cost for a doubling of global installed capacity.

Tesla megapack is an example of cost reduction

For batteries of the 1MW and up scale, and if you are in the Tesla ecosystem, the Megapack is replacing the PowerPack.

Tesla claims a ten times faster installation and a 40 per cent smaller footprint for a “Megapack” over the equivalent capacity of linked “PowerPacks”.

There is a 60% increase in energy density. A 40% smaller footprint implies lower land cost but also lots less expensive wire. Tesla claims a 250MW/4 hour battery can be deployed in 3 months on a 1.2 hectare site, etc.

The point is this is not just expectations in a spreadsheet, but real world cost reduction happening very quickly. Despite the hype, Tesla is probably neck and neck with Fluence globally in the lithium battery market, and Fluence may well be bigger in the utility market with around 2 GW of business.

Batteries do get cheaper with duration

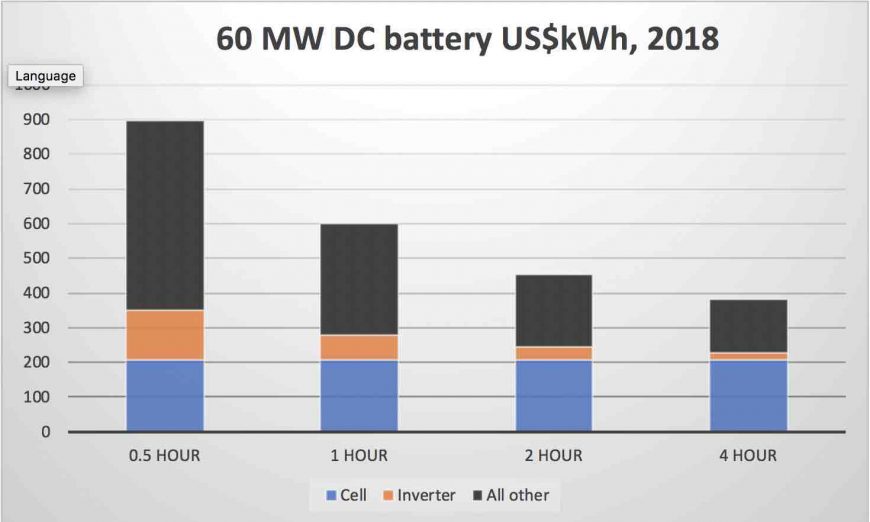

Figure 5 shows storage getting cheaper per hour as duration increases. That is: a 4 hour battery is much cheaper than a one hour battery at least in 2020.

The reason that you don’t, so far, see four hour batteries in Australia is that the value case for batteries today is in FCAS and you don’t need much duration for that.

The following chart, derived initially from NREL data, divides a battery into three components, the cell, no duration unit cost benefit, the inverter, full duration unit cost benefit and remaining BOS, some duration benefit.

A 1 MW inverter works just as well on a 4 hour battery as a 1 hour battery. By the time you get to 4 hours, it’s the cell cost that dominates.

Battery value stack

Despite all the good news on battery prices, even in 2025 ITK still expects that 6-8 hour duration batteries will require about $80-$90/MWh of margin per hour..

That is 6 hours x $90 or about $450 per day per MW of usable capacity to produce a 5% IRR (internal rate of return). That’s if they were used purely for time shifting or energy arbitrage.

What’s interesting is that a pumped hydro plant also requires about $90/MWh for 6 hours duration on a daily cycle. And that’s even if pumped hydro costs come in at the optimistic end of the scale.

And they won’t do that if pumped hydro doesn’t get an opportunity to move down the learning rate curve.

And lets face it, we’ll be lucky if there is more than one or maybe two new pumped hydro plant is operating in the NEM by 2025, but I’ll be surprised if there aren’t about 1-2 GW of utility scale batteries operating by then.

And the reason is that all the other value services that batteries can provide, not only and principally frequency control, but also the ability to provide current, and the ability with other equipment to stabilise voltage. All of that in an instant.

The University of Queeensland recently ran a fantastic seminar on their 1.1 MW battery and the associated UQ battery analysis. Its required reading for anyone wanting to understand the topic. However, the graph that is of interest here is the frequency performance.

The battery went from charging almost flat out to fully discharging in less than 1 second.

Provision of these services takes only a very small amount of battery capacity but produced the majority of the revenue for this battery in this quarter.

Bottom line. Batteries are really, really good at frequency control.

But how much duration is needed?

ITK contends that the duration of required storage is related to the VRE (variable renewable energy) fraction of energy.

A standard way to look at this is to look at VRE production in a region over the past 12 months and then gross it up. I.e, if NSW had 500MW of wind operating last year, then 5000MW of wind would produce ten times as much energy every half hour of the year.

Of course wind patterns will vary a bit from year to year but nevertheless we can hopefully get a good idea of output. Quite a few studies have now been done and as we start to build up wind and solar output all around the NEM we get a better idea of the portfolio effect.

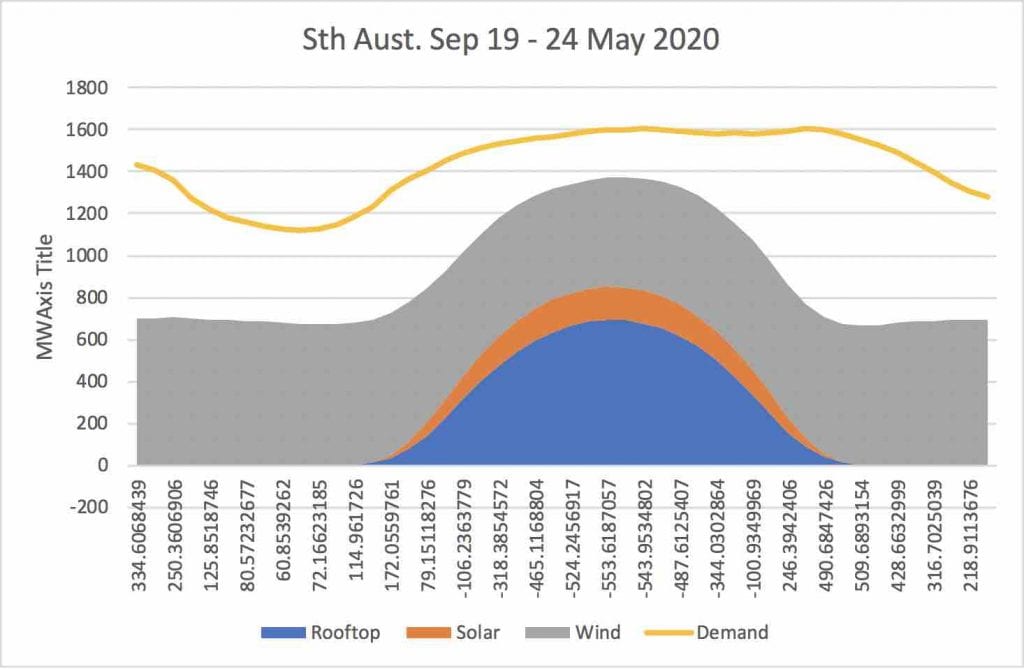

There’s an awful lot to be said about this, but not much space today. Still, let’s look at South Australia.

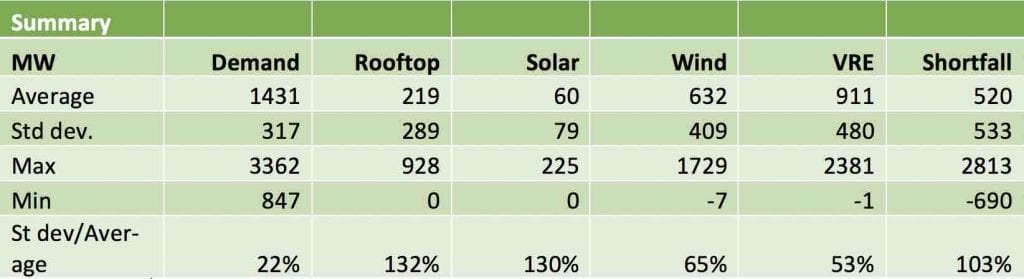

We start by showing wind and solar output compared to demand on an hourly average. VRE is 61% of demand in this period and the period included when Sth Aust was islanded and supplying the Portland aluminium smelter. And that smelter, in that brief period, operated without a hitch.

A couple of summary stats:

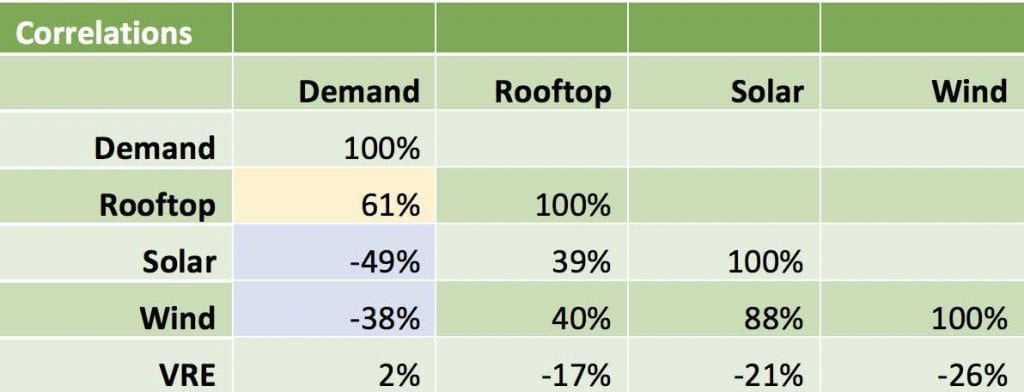

Given enough transmission NEM wide correlations are what we should focus on, but here let’s look at Sth Australia in isolation

Looking at the correlation matrix reminds us why statistics have to be considered carefully. But on the face of it there is a low correlation between VRE and demand (bad) but rooftop is reasonably correlated with demand (good).

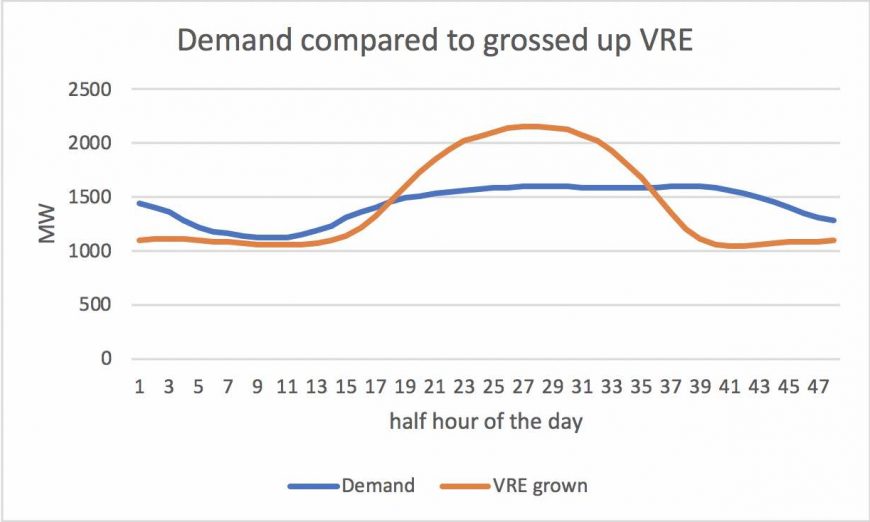

So with that background what we did is grow VRE supply by 5/9 = 55% so that average VRE output is equal to average demand.

This produces periods of surplus VRE (which is ignored but can be treated as storage charging opportunities) and shortage. On a daily average.

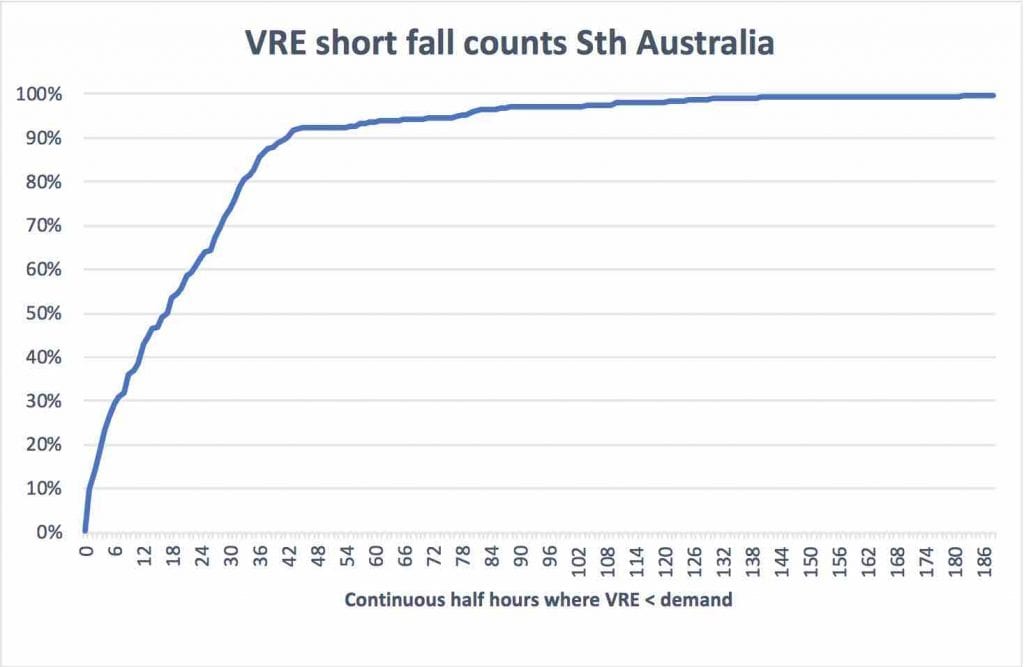

Then we looked at the duration of shortfalls. That is we counted how many consecutive half hours at a time VRE would be less than demand in a particular half hour.

There were 226 negative runs, that is at least a full hour where VRE was less than demand even though on average over the entire 8 months VRE equalled demand.

In this simple case it’s not the quantity of the shortfall but the duration that we focused on.

The longest short fall was 188 half hours, basically 4 days.

That was unusual of course. 30% of the time 4 hour storage was enough and 8 hours of storage would be enough 50% of the time. 85% of the time the requirement was 18 hours or less.

The chart below has “shortfall duration runs” on the horizontal axis and the vertical axis shows the cumulative percentage of runs ordered by number of half hours of each run.

What we conclude from this is what we have always known. A portfolio approach to firming power is needed. Some firming energy will run every day and can earn a return in the energy market.

Other firming capacity of much longer duration, let’s say its gas, will be needed very occasionally and it’s probably more appropriate to pay for it through a capacity market.

Of course, batteries can always run consecutively, rather than concurrently, and demand response has a role.

Imagine, for instance, if Portland Smelter just ramped down its output by 20% for 4 days. Would that damage its pots? Very unlikely.

Clearly though these sorts of numbers suggest a roll for pumped hydro with duration of 10-25 hours. But only Tasmania Hydro and Snowy 2.0 are currently talking about offerings in this space.

https://reneweconomy.com.au/lets-talk-a ... dro-50625/