Re: News & Discussion: Electricity Infrastructure

Posted: Tue Sep 01, 2020 12:44 pm

South Australian Power Networks are trying to make people with rooftop solar PAY to export their energy.

This is an outrageous proposal considering SAPN already charge electrical retailers for using their power lines to access the power from rooftop solar.

From Renew Economy

From Renew Economy

This is an outrageous proposal considering SAPN already charge electrical retailers for using their power lines to access the power from rooftop solar.

From Renew Economy

And I doubt whether the pumped hydro proposals for South Australia will ever receive funding.....batteries continue to fall in price undercutting the need for pumped hydro.SAPN flags potential to “ramp down” rooftop solar with new network upgrades

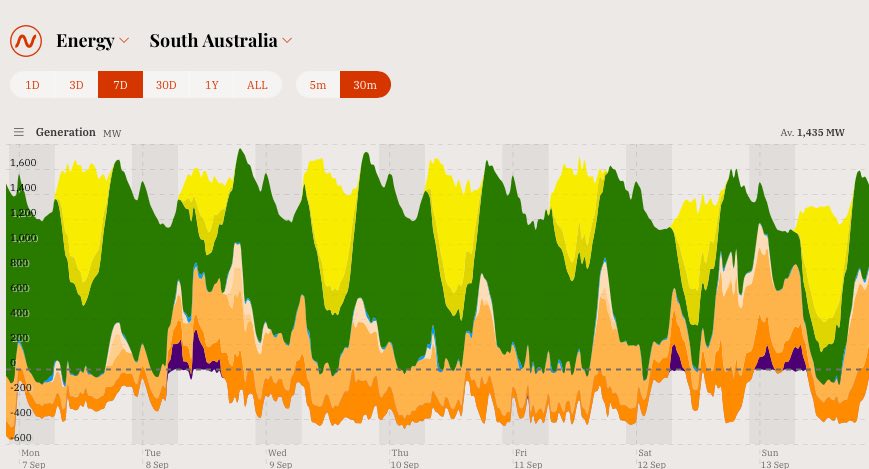

South Australia electricity distribution company SA Power Networks has announced it is forging ahead with upgrades to voltage management systems at around 140 substations, as a first step to accommodate more rooftop PV onto the state’s grid.

SAPN said on Monday that it was moving quickly on the state government-backed upgrades to support both the state’s fast-growing number of rooftop solar customers and the Australian Energy Market Operator on broader security of supply issues.

Those broader network security issues have come under the spotlight in the past few weeks in South Australia, with the state government also fast-tracking – much to the solar industry’s consternation – new PV, battery storage and smart meter rules to manage the growing share of distributed energy.

As RenewEconomy reported late last week, there has been no shortage of criticism of the reforms, with questions around whether proposed new inverter standards and wiring codes are the right way to go, and concerns that the solar industry will be bear the brunt of poorly communicated changes.

For its part, SAPN says the rapid deployment of new voltage control measures in some of its larger substations will help to provide a more stable platform, by better regulating grid voltage levels throughout the day and year.

“During those periods of high solar export in the middle of the day, we can keep the volts down to ensure customers can continue to export their excess power to the grid,” said SAPN’s manager of corporate affairs, Paul Roberts, on Monday.

On top of that, Roberts said, the work would give SA Power Networks the ability to assist AEMO in managing supply/load issues on the broader national grid – in particular, to manage South Australia’s rooftop solar load in the event the interconnector to Victoria goes down.

“AEMO has said it may need us to help, as a last resort, in the unlikely scenario that the interconnector goes down on a few days of the year that we experience ‘minimum demand’,” said Roberts.

“We would do this by making small changes to voltage at targeted substations. Our trials have confirmed we can do this effectively and safely while maintaining ongoing electricity supply for customers.”

In separate emailed comments to RE on Monday, SAPN further stressed that AEMO had made it clear there had to be “a specific and rare set of circumstances” to trigger an instruction for the network operator to ramp down solar generation.

These included low demand, high solar generation and loss of the interconnector with Victoria – and only in the next couple of years prior to construction of the proposed SA-NSW interconnector.

As for how this would be done, Roberts explains: “We can implement this by lifting volts to the upper end of the allowed voltage range in local areas.

“This is something that can be experienced in some areas of our network already and it trips off inverters. We have conducted two trials that successfully tripped inverters without impacting customers’ electricity supply. It is a capability we have not previously had but will be able to implement with the support of the SA government.”

Meanwhile, on a completely separate issue, and for a separate set of planned and costed grid upgrades, SAPN has petitioned the AEMC to change national market rules to allow for solar households to be charged a fee to export their excess generation to the grid.

This, too, has generated controversy, with solar advocates arguing that this would become a disincentive for people to install solar in South Australia, while unfairly penalising those households that have already invested in rooftop PV.

But SAPN argues that what it is seeking is simply a clear framework that enables it to meet “clear customer demand” to install more and more solar systems and other forms of distributed resources.

“The first question is do you want additional solar to be added to the network, and we have trouble with the train of logic after that, that ends up with no-one pays,” said SAPN’s Mark Vincent in an interview with RenewEconomy earlier this month.

“The message from customers is loud and clear: we would like network investment to support more solar. So we think the rules should enable us to do that, clearly, and not have to hedge around to try and make that work,” said Vincent.

“Up until now, (the cost of upgrading networks to accommodate more solar) is spread across all customers, but that’s not what we would call cost-reflective.

“From our perspective, to the extent that it is solar customers that are driving those costs, and noting they get a significant benefit in terms of the bill savings or credits they get in selling that energy to the market, if they were to pay a small fee for that service then that would seem reasonable to us.”

Bryn William, SAPN’s future network strategy manager, said the perception that distribution companies were somehow at odds with accommodating more distributed solar was frustrating and inaccurate.

“It’s tremendously exciting as a distribution network,” he told RE in the same interview. “Australia is quite unique in the fact that this is really a distributed energy transition as well as a renewable energy transition, … the distribution network is becoming much more kind of the heart of the whole energy system.

“Most of the energy that’s flowing around from customers, from producers to consumers is increasingly coming from small-scale PV, it’s customers’ batteries participating in virtual power plants … It’s incredibly exciting and it’s unquestionably a good thing for networks.

“It tremendously increases utilisation of the network – we’ve got sections of our network that for the last 60 years or so would sit doing almost nothing during the middle of the day in residential areas when no one’s home that are now humming with energy that’s flowing off to businesses that can consume that energy.

“So it’s a very exciting future for us, in particular, for the role that we play in the energy system. I think that’s why … it’s a little bit concerning to us that the perception is that networks are somehow threatened by this transition when you look at what networks are doing, networks are making every effort to try and enable this transition, and this rule change is part of that.”

https://reneweconomy.com.au/sapn-flags- ... des-98258/

From Renew Economy

Pumped hydro projects left high and dry, still waiting for funding news

it’s been nearly three years since South Australia rolled out the first of its large scale pumped hydro project proposals, and more than 12 months since the Australian Renewable Energy Agency announced it would fast-track the first of these projects. But still nothing has happened.

Around half a dozen different pumped hydro projects have been suggested by various parties for South Australia, where the need for added storage is considered greatest at it jumps from its already world leading share of 55 per cent wind and solar to the state Liberal government’s target of “net 100 per cent renewables” by 2030.

Last August, ARENA said it would allocate $40 million to fast-track the first of these pumped hydro storage proposals and drew up a short list of four candidates.

Those shortlisted projects were Sunset Power and Delta Energy’s 242MW/1,835MW Goat Hill project near Port Augusta, Rise Renewables and UPC’s 250MW/2,000MWh Baroota project, EnergyAustralia’s 225MW/1800MWh Cultana sea-water project north of Whyalla, and AGL’s 250MW, 2000MWh Kanmantoo project.

AGL then withdrew because its partner found more ore at the mine they were going to use, and decided against closing the mine and filling its pits with water. In February this year, ARENA said it had selected its preferred option, and would make an announcement before the middle of the year once funding discussions were complete. We’re still waiting for the news.

An ARENA spokesperson told RenewEconomy by email that the organisation continues to work with the sponsor of the preferred project.

Full story : https://reneweconomy.com.au/pumped-hydr ... ews-38500/