News & Discussion: Electricity Infrastructure

Re: News & Discussion: Electricity Infrastructure

Is there anyone here with enough electrical engineering knowledge to answer a simple question?

Transformers are installed on a grid designed to distribute electricity from power stations through high voltage lines decreasing down in stages to deliver at 240v to houses. Can the existing transformers automatically switch to taking the excess solar power from a street/suburb and stepping it up in voltage to the distribution and transmission network? Does this work seamlessly, including maintaining the frequency and phase if all of the leaf transformers switch from receiving to transmitting electricity on the next "upstream" grid segment?

If transformers end up feeding the same grid segment, but out of phase, I imagine the result is like noise-canceling headphones.

Transformers are installed on a grid designed to distribute electricity from power stations through high voltage lines decreasing down in stages to deliver at 240v to houses. Can the existing transformers automatically switch to taking the excess solar power from a street/suburb and stepping it up in voltage to the distribution and transmission network? Does this work seamlessly, including maintaining the frequency and phase if all of the leaf transformers switch from receiving to transmitting electricity on the next "upstream" grid segment?

If transformers end up feeding the same grid segment, but out of phase, I imagine the result is like noise-canceling headphones.

Re: News & Discussion: Electricity Infrastructure

What do the other batteries do? We always hear about the large Tesla battery (Hornesdale) but what about the smaller ones?

Here's an article on the Dalrymple battery which recently repaid a grant (not a loan, a grant) from the federal government agency ARENA.

Also the Yorke Peninsula battery oversees the world's largest micro-grid (when activated by the electricity market overseer)

From Renew Economy

Here's an article on the Dalrymple battery which recently repaid a grant (not a loan, a grant) from the federal government agency ARENA.

Also the Yorke Peninsula battery oversees the world's largest micro-grid (when activated by the electricity market overseer)

From Renew Economy

Also further interest in green Australian hydrogen from the Germans.South Australia’s “other” big battery repays ARENA grant after windfall returns

One of South Australia’s “other” big battery installations, the 30MW/8MWh ESCRI ElectraNet battery storage system at Dalrymple, has earned enough revenue in its first two years of operation to return the $12 million in grant funding provided by ARENA to the project.

In a report published this week as part of a “knowledge sharing” deal that came with the funding, ARENA said the ESRCI had earned $22.6 million in frequency control ancillary services revenue and $319,820 in discharging revenue between December 2018 and December 2020.

“FCAS revenue peaked in the six months from December 2019 to June 2020, earning $15.6 million in addition to $102,000 discharging revenue, from a $76,000 charging cost,” the ARENA report says, indicating it cashed in on the same “islanding” event that deliver a huge windfall to the better known Tesla big battery.

“The arbitrage and FCAS markets provided revenue streams for the battery, allowing ElectraNet to return the $12 million ARENA provided to the project.”

As RenewEconomy reported six months into the battery’s operating life, the South Australia ESCRI – which stands for Energy Storage for Commercial Renewable Integration – is not as big nor as headline grabbing as the Hornsdale Tesla big battery, but it does do a number of things the Tesla battery can’t.

On top of the more standard skills of operating in the FCAS market and trading caps, the ESCRI – which is charged by AGL Energy’s 90MW Wattle Point wind farm – is configured to allow “islanding” of the Yorke Peninsula, to keep local lights on in case of grid problems elsewhere.

The “grid-forming” inverter capabilities it has pioneered on the main grid (the ability to use battery inverters to “create a grid”‘) are considered critically important, as they will be key to fashioning a renewables-based grid without synchronous generation.

The ESCRI has also supplied Fast Frequency Response (FFR) ancillary services into South Australia, reducing constraints on the Heywood interconnector linking SA and Victoria, and delivering increased flows, and reduced the amount of unserved energy to the region following losses of supply.

On this front the battery continues to impress, according to ARENA, which reports that in the two years from December 2018 the ESCRI was called on in 29 system events, responding almost instantly to inject power to arrest dips in voltage or reduce the duration of an outage.

One event in December of 2019 happened when lightning caused a nearby powerline to trip, at which point the battery maintained Dalrymple’s energy supply until the issue was resolved.

Not long after that, a catastrophic failure tripped a series of transmission lines, the report adds. On this occasion, the battery responded immediately, supporting the network to recover from the sudden voltage dip to become stable within 2.5 seconds.

“As one of Australia’s – and the world’s – first large-scale battery storage systems, the project has broken a lot of new ground,” the ARENA report says.

“[It has] delivered the largest autonomous regional microgrid, able to operate both connected to the NEM and also be islanded. In islanded mode, demand for electricity in the region is met entirely by renewables, with network regulation services provided by the battery.

“This has provided insights into what will be required to operate the South Australian electricity system with 100 per cent renewable energy,” ARENA says.

https://reneweconomy.com.au/south-austr ... qus_thread

German energy giant RWE in key green hydrogen trading deal in South Australia

Australian hydrogen project developer The Hydrogen Utility (H2U) and German energy giant RWE plan to develop a green hydrogen trading scheme between Australia and Germany which would transport green hydrogen produced in South Australia into Europe.

Full story : https://reneweconomy.com.au/german-ener ... australia/

Re: News & Discussion: Electricity Infrastructure

Not an Electrical Engineer, but I am a Civil Engineer in the industry and my understanding is that some substations are set up so that the transformer can work both ways, however there are many that can't. This has led to some areas being prone to voltages creeping high. This is the reason regulations were introduced so that new solar has to be able to be switched off by SAPN.

Sent from my SM-G973F using Tapatalk

Sent from my SM-G973F using Tapatalk

Re: News & Discussion: Electricity Infrastructure

That's roughly how I understood it too. I don't know if the reverse direction requires separate transformers, or exactly what is needed, but I understand that maintaining the AC frequency waveform is important. That's what "synchronous generation" is all about that large flywheels on thermal power stations provide. I gather there are other ways of providing it, such as "synchronous condensers" which do the spinning without either consuming or generating electricity, and some batteries can do it too. The challenge is that the waveform has to stay in phase on either side of the transformer, and as the "downstream" generation rises, there will be a point with virtually no flow either way across the transformer.kingy wrote: ↑Mon Apr 19, 2021 7:41 pmNot an Electrical Engineer, but I am a Civil Engineer in the industry and my understanding is that some substations are set up so that the transformer can work both ways, however there are many that can't. This has led to some areas being prone to voltages creeping high. This is the reason regulations were introduced so that new solar has to be able to be switched off by SAPN.

Sent from my SM-G973F using Tapatalk

Remote control means "they" can either scale down the panels on a few houses or shut one or two off, and keep the rest of the street/suburb/town running (including the house under the shut down panels). Without it, the only way is to completely shut down a segment, which trips out all of the generators, then repower it from the transformer end once the oversupply should have ended.

Re: News & Discussion: Electricity Infrastructure

Renewables reach 82% share in the first quarter of 2021......Wow!

From Renew Economy

From Renew Economy

Rooftop solar sends average South Australia daytime power prices below zero

South Australia has set a stunning new benchmark in the electricity market, with its big share of rooftop solar sending the average daytime wholesale price of electricity to below zero in the first quarter.

According to the Energy Market Operator, the average price of wholesale power in South Australia between 10am and 3.30pm was minus $12/MWh in the three months to March 31 – the first time this has occurred in Australia’s main grid.

South Australia already leads the world in the share of wind and solar in its grid – 60 per cent over the last 13 months – but it is the growing impact of rooftop solar that is causing the biggest frowns at AEMO as it tries to keep the grid stable and the lights on.

Rooftop solar provided an impressive 47.7 per cent of the state’s generation mix in that three month period, and wind and solar overall provided 82.5 per cent of generation over the quarter, despite some wind and solar farms switching off at times to dodge the negative prices.

Rooftop solar has at times provided a “world first” equivalent of 100 per cent of the state’s demand (when excess wind and solar is being exported to Victoria), but in the latest period its peak was 78 per cent on February 14.

Already this year, AEMO has had to make a first of its kind intervention in the market to order the switching off of 71MW of rooftop and distributed solar to ensure that demand can be maintained at required levels.

It has had to intervene in some form on 70 per cent of occasions to ensure sufficient gas generators are operating, mostly ordering them to generate power even though the prices were below the cost of generation. This cost a total of $18 million over the quarter.

The need for this intervention will be removed once new synchronous condensers, which do not burn fuel but provide the same “synchronous” power needs as gas plants, are switched on in coming months. In the longer term, battery storage with “grid forming inverters” are expected to do the job.

AEMO says a new minimum demand level of 358 MW in South Australia was set on Sunday, March 14, when it issued instructions to switch off certain amounts of distributed solar to ensure that operational demand stayed above 400MW, as we reported exclusively at the time.

The “switch off” mechanism has been fast-tracked in South Australia because of the growing share of rooftop solar, which can equate to 100 per cent of local demand on occasions, are may be replicated in other states as they also experience lower levels of operational demand.

South Australia is also looking to extend these “switch off” or “switch down” mechanisms to other appliances such as air conditioning units, pool pumps, and electric hot water systems, although proposals to control home EV charging equipment in the same way has been met with stiff opposition from the EV industry.

The growing number of negative pricing events is having a growing impact on other technologies, with many wind and solar farms choosing to switching off during negative pricing events because they are either obliged to do so by their contracts, or because they don’t want to pay to generate.

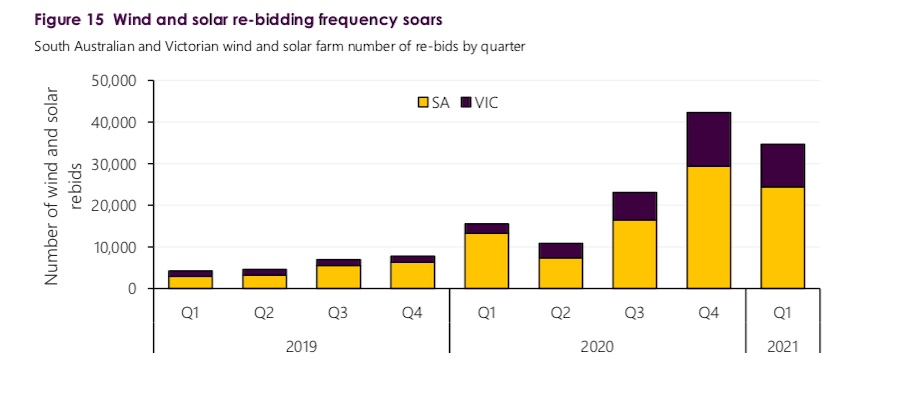

AEMO estimates that around one-third of South Australian and Queensland wind and solar capacity has installed automated bidding software, with a slightly smaller amount (around 20%) in Victoria. The facilities most hit by economic curtailment were the Tailem Bend solar farm and the Lincoln Gap wind farm, both in South Australia, and the Murra Warra wind farm in Victoria.

Interestingly, the level of curtailment overall was down sharply, mostly due to the removal of grid constraints, including the solving of inverter issues in the West Murray region (which had badly impacted five solar farms), and the success of new inverter settings in Queensland which had solved system strength issues and reduce curtailment to near zero.

The negative prices and the growing share of wind and solar had a flow on effect on average spot prices, and futures prices, with South Australia now boasting the lowest prices in the main grid, on a futures basis. These falls in wholesale prices are now flowing through to customer bills, or at least they should be.

https://reneweconomy.com.au/rooftop-sol ... elow-zero/

Re: News & Discussion: Electricity Infrastructure

A Canadian company has bought into a couple of SA renewable projects and wants to make green hydrogen here.

From Renew Economy

And it looks like the NSW-SA Interconnector is inching towards approval.

From Renew Economy

Amp makes massive South Australia solar, battery, green hydrogen play

Canadian clean energy investor Amp Energy has big three solar and battery projects in South Australia as part of a $2 billion play to create a zero emissions hydrogen production hub.

Amp, headquartered in Toronto, says it has bought the three projects from Australian renewable energy consultancy EPS, and they total more than 1,300MW of solar capacity with up to 540MW of big battery capacity, and will feed a new green hydrogen hub at Port Spencer.

The projects involved are the 636MW Robertson solar project, near the major sub-station from where a proposed new transmission link to NSW will be built, along with the 336MW Bungama project and the 388MW Yoorndoo Ilga project.

Amp says the Robertson and Bungama projects are ready to progress to construction, having already secured development approvals and the land required for the projects. In its statement, it says it expects the projects to commence “staged energisation” in late 2022, which suggests construction will have to start late this year.

The projects are expected to create up to 550 full-time jobs during their construction.

”The strategic value of the South Australian portfolio is significant in a jurisdiction which is undergoing one of the most rapid energy transitions in the world,” head of the newly formed Amp Australia, Dean Cooper, said in a statement.

Amp flagged that it is also progressing plans to establish green hydrogen production facilities in South Australia, as part of a proposed Spencer Gulf Hydrogen Energy Ecoplex, that Amp would use to produce hydrogen for export, leveraging its existing presence in other Asian markets.

Last year, the South Australian state Liberal government announced plans to establish three hydrogen hubs in the state, including a hub at Cape Hardy/Port Spencer, part of its plans to move beyond its 2030 target of “net 100 per cent renewables” to become a green hydrogen exporter requiring the equivalent of 500 per cent renewables.

Amp’s announcement was welcomed by South Australian minister for trade and investment, Stephen Patterson, who said the initiative will help the state achieve an ambition of 100 per cent renewable electricity by the end of the decade.

“South Australia has significant land mass and world-class wind and solar resources, with aspirations of reaching net 100 per cent renewable energy generation by 2030,” Patterson said.

“We have seen over $7 billion invested in projects with another $20 billion in the pipeline. The Renewable Energy Hub of South Australia will be fundamental in integrating our state’s renewable energy storage assets and building our capability and supporting the fast-moving energy transitions we’re experiencing.”

Amp already owns a portfolio of 158MW of solar projects in Australia, after first entering the local market in 2017, that either already operating or under construction in New South Wales, including the 39MW Molong solar farm new Orange that commenced full generation in December last year.

Amp says that the company’s expansion into the Australian market will also see it deploy its Amp X digital energy platform, which provides solutions for grid management, including virtual power plants, demand response services and the optimisation of distributed energy resources like rooftop solar and battery storage.

Amp Energy currently has a portfolio of around 4.6GW of projects globally, that are already operating or currently under construction.

https://reneweconomy.com.au/amp-makes-m ... ogen-play/

And it looks like the NSW-SA Interconnector is inching towards approval.

Final pitch made for new transmission link critical for major wind, solar projects

Transmission companies ElectraNet and Transgrid have made their final pitch to the regulator for the proposed new $2.4 billion link between South Australia and NSW, arguing it is essential for Australia’s clean energy transition and will unlock significantly bigger benefits than previously thought.

The new filings to the Australian Energy Regulator for the 900km, 800MW Project EnergyConnect (PEC) transmission link is the last major hurdle in what has been a typically drawn out regulatory process.

The AER has previously expressed concern about the amount of monetary benefits from the project, particularly after a blowout in construction costs, but its approach has also been criticised as too narrow and lacking the broader benefits of the clean energy transition, of which PEC is seen as a critical component.

The Australian Energy Market Operator took the near unprecedented step earlier this year to urge the AER to support the project, arguing that it would deliver small but important net benefits under current market scenarios, but would deliver significantly wider benefits in the event of a rapid exit of coal from NSW.

The project has also received the backing of the two state governments, both moral and financial, with South Australia energy minister Dan van Holst Pellekaan supporting AEMO’s letter to the AER with the message: Get on with it”.

ElectraNet and Transgrid have also been battling the main market rule-maker, the Australian Energy Market Commission, in an attempt to fast forward some of the revenue from the project to help manage the significant debt that will be incurred. That was rejected but the network companies are ploughing on anyway.

They have also been battling incumbent coal generators who have sought other rule changes that would narrow the regulatory approval process even further.

“This is an important project for the national electricity grid and is a priority project for ElectraNet, the Australian Energy Market Operator (AEMO) and many other stakeholders,” ElectraNet CEO Steve Masters said in a statement.

“ElectraNet is mindful of the rapid pace of change across the NEM and the importance of the project delivering the expected benefits for customers,” Masters said.

Masters said benefits from recent policy and market developments – which were not included in AEMO’s 2020 Integrated System Plan – and have concluded that overall, the project benefits are likely to be between $190 million and $440 million higher than previously forecast.

ElectraNet says this will translate into a $100 a year reduction for South Australian electricity consumers, and $60 a year for NSW customers.

But the biggest benefit will come in the link’s ability to unlock vast amounts of new wind and solar projects, and help South Australia meet its net 100 per cent renewable energy targets, and NSW in its accelerated transition away from coal.

The AER says it will make a decision as soon as it can, and it has about 40 business days to do so. The two network companies will then take that ruling back to their boards for a final investment decision. If they go ahead, and the environmental impact statements are accepted, then construction will begin in November and could be complete by 2023.

That process is expected to trigger a wave of new project commitments in both states, but particularly in South Australia, where the new link will remove many of the grid constraints that currently limit the output of wind and solar in that state, even though it already sources an average 60 per cent of its demand needs from these two technologies.

“The SA-NSW Interconnector is a critical project to deliver the Marshall Government’s intention of net-100% renewables by 2030,” van Holst Pellekaan said in a statement on Tuesday.

“The Marshall Government has been underwriting work on the interconnector, with approximately $75 million for early works to get the route selected, development application lodged, towers designed and contractors secured.

“This means that with a final investment decision, construction will commence promptly to deliver the project as soon as possible to benefit consumers.

https://reneweconomy.com.au/final-pitch ... -projects/

Re: News & Discussion: Electricity Infrastructure

Ampol is about to install solar panels and batteries at its service stations as a trial. The batteries will be connected together as a VPP, sending electricity back to the service stations and sold into the grid.

Not the biggest development ever but will be interesting to see if other companies do the same thing if the Ampol trial is successful.

From Renew Economy

Not the biggest development ever but will be interesting to see if other companies do the same thing if the Ampol trial is successful.

From Renew Economy

Ampol to trial green hydrogen production and Tesla battery VPP at outlets

ASX-listed fuel company Ampol will trial the production of green hydrogen and the addition of Tesla batteries across a number of its service station sites, forming a virtual power plant, as the company commits to zero net operational emissions by 2040.

Ampol said it would trial new “revenue opportunities” through the addition of Tesla Powerwall batteries and solar panels across three of its South Australian retail sites.

Three of its fuel stations will have between 55 and 99 kilowatts of solar panels installed, along with between six and nine Tesla Powerwall batteries. The systems will be aggregated through a dedicated “virtual power plant” that will be managed by Evergen and which the company expects will be able to deliver new revenues for the stations.

The company is targeting the use of 40 per cent renewables in its retail operations by 2025, increasing this amount to 50 per cent by 2030. Its part of a wider commitment to zero emissions, which does not, however, include the emissions from the fuel it sells.

Te fuel company said that it still anticipates to be selling petrol fuels to customers beyond 2050, and emissions from these sales will not be included within its goal to achieve net zero emissions.

The company said that it would partner with the Irish technology firm Fusion Fuel Green to trial the production of renewable hydrogen at its Lytton refinery site in Queensland.

The green hydrogen trial will involve the deployment of Fusion Fuel’s concentrating solar PV technologies, and combined with an electrolyser, to convert the renewable electricity into hydrogen. Ampol will stop short of offering hydrogen refuelling services directly to drivers but will make the renewable hydrogen produced at the facility available for wholesale customers.

The hydrogen pilot project is expected to be up and running within the next 12 months, and if successful, Ampol says the trial could serve as the basis of a much wider roll-out of hydrogen production facilities.

Ampol recently secured federal government funding to keep its fuel refinery, located in Lytton in Queensland, open until at least 2030. The funding will be provided as part of a $2.3 billion package that will prop up Australia’s last two major fuel refineries – along with Viva Energy’s refinery in Geelong – that struggling to remain viable as a result of international competition.

https://reneweconomy.com.au/ampol-to-tr ... t-outlets/

Re: News & Discussion: Electricity Infrastructure

South Australia's large battery played a part in the NEM grid stabilization after the the fire at the Biloela coal power station that left 350,000 Queenslanders without electricity even though the battery is probably 4000 kilometres of wire away.

From Renew Economy

From Renew Economy

“Virtual machine”: Hornsdale battery steps in to protect grid after Callide explosion

The newly expanded Hornsdale Power Reserve, aka the Tesla big battery, has reported a successful “real life” test of its new “virtual machine mode” when it reacted to the grid disturbances created by the Callide coal plant explosion in Queensland on Tuesday.

The Callide explosion, and the subsequent trip of its neighbouring units, had a cascading impact on the Queensland grid, cutting power from nearly half a million customers through the state. But it also had an impact on the rest of the grid, creating a frequency excursion that had to be addressed.

That’s where the Hornsdale Power Reserve stepped up, in what turned out to be a satisfying “real world” test of its newly expanded tool-kit that has been added since it expanded its size last year from 100MW/129MWh, to a once world-leading but still country-leading 150MW/194MWh.

These tools are variously described as “synthetic inertia” or a “virtual machine”, or “grid forming inverters”. What it is designed to do is to provide the inertia services that will slow down the rate of change of frequency that can be caused by dramatic events such as the Callide explosion.

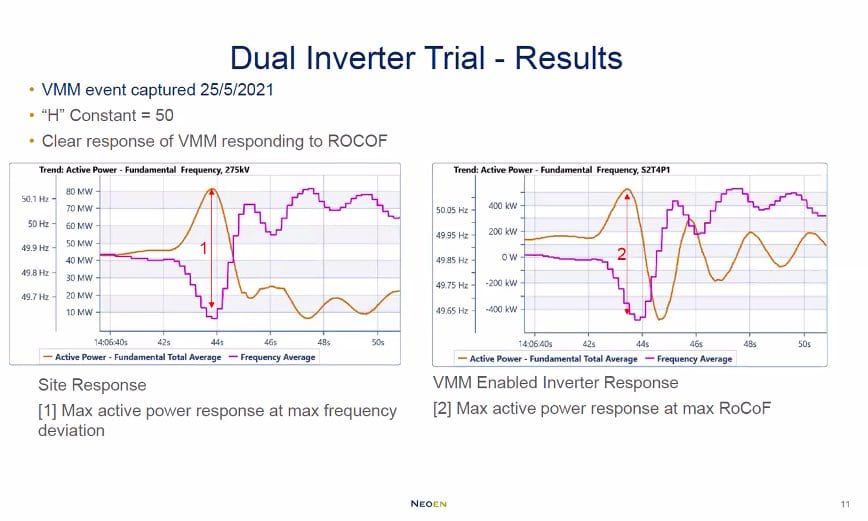

This graph above (on the left) shows how the Hornsdale battery (orange line) responded instantaneously as frequency in the grid (purple line) initially plunged to a low of 49.6 Hertz as the events in Callide cascaded and caused multiple generators to trip, and then jumped to 50.1Hz as load was lost.

It did all of this in two seconds, and that’s pretty much what Hornsdale and other big batteries are set up to do, and have been doing successfully. What’s interesting and new is the graph on the right and how the battery’s new bag of tricks responded to Tuesday’s calamitous events.

This is about delivering “inertia” and getting “in front” of the frequency curve when there is a bad event (like a big coal generator exploding and catching fire), and trying to slow down the rate of change of frequency. It’s a crucial grid service normally delivered by spinning machines, and now being trialled by batteries.

What this graph shows is that the two inverters at Hornsdale that have been enabled with “synthetic inertia” or “virtual machine mode” responded even more rapidly, and reached peak output about one third of a second before the rest of the battery.

These inverters, operating in “virtual machine mode,” detect excursions as they happen and by slowing the rate of change of frequency (ROCOF) they give the grid more time to respond.

“This shows that the virtual inertia mode hopes to catch these things even earlier,” Neoen’s Garth Heron says. “This is the future.”

That’s a bold claim, but it is what the (progressive) side of the electricity industry is now thinking: How the grid will look without synchronous machines such as coal and gas generators, and these new technologies are proof that it can be done.

Behrooz Bahrani, from Monash University, told a webinar hosted by the Australian Renewable Energy Agency on Thursday on the subject of grid forming inverters – and where the Hornsdale results were presented – that it was clear battery storage can provide inertia and “system strength”, and that grid operators need to think beyond old parameters.

“We need to go beyond synchronous generators,” Bahrani said. “We need to think what else the batteries can do and not just focus on mimicking synchronous generators.”

Sachin Goyal, from Powerlink, which has been running its own research on inverter based technologies and their abilities to solve system strength issues, agreed:

“Any inverter that connects to grid is more stable than synchronous generation. We should not be blindly following what synchronous generators can do, we should be taking the best parts and adding to them.”

Neoen’s Garth Heron says it is clear from the tests at the Hornsdale battery that inverter based technologies can deliver the same inertia responses as synchronous machines twice their size.

And he reinforced the fact that battery storage has layers upon layers of skills and services, many not recognised yet by the market. The trick is to get a control system that delivers the right response from the battery under all situations.

Neoen, which owns the Hornsdale battery, hopes to be rolling out the “virtual machine mode” to the rest of the battery by the end of the year, once more extensive modelling is complete to the satisfaction of the Australian Energy Market Operator.

Transgrid, meanwhile, is planning on doing the same thing as its 50/75MWh Wallgrove battery currently being built in western Sydney and which will use Tesla Megapack technology (as opposed to the smaller Powerpacks at Hornsdale).

And, in interesting news just in from Queensland, just two days after the Callide event, the state-government owned Stanwell has announced it will build a 150MW big battery next to its Tarong coal fired power stations as part of a Queensland “battery blitz.”

Neoen is also hopeful of building an even bigger battery at Western Downs, next to the 400MW solar farm it is now constructing, as well as another big battery next to the Kaban wind farm which it will build in north Queensland, despite the veto of a NAIF financing deal by resources minister Keith Pitt.

https://reneweconomy.com.au/virtual-mac ... explosion/

Re: News & Discussion: Electricity Infrastructure

Gupta's Cultana Solar Farm and Playford battery have officially been cancelled by GFG.

There is some hope that both projects could be "sold on" as they both have approval.

There is some hope that both projects could be "sold on" as they both have approval.

Gupta’s GFG Alliance cancels plans for Cultana solar farm and Playford battery

Sanjeev Gupta’s struggling GFG Alliance has cancelled its plans to build the state’s biggest solar farm and a big battery to supply power to both his Whyalla steel works and the South Australia state government.

GFG revealed last month it was seeking buyers for the 280MW Cultana solar project and the 135MW Playford big battery project, following its financing issues provoked by the collapse of its major backer Greensill.

It is understood that EY has been mandated to pursue buyers.

In the meantime, in a brief comment posted on its web-site on Tuesday, the Essential Services Commission of South Australia said the generator applications for both Cultana and the Playford battery had been withdrawn by GFG offshoot Simec Energy.

“On 28 May 2021, Simec Energy Australia notified the Commission in writing, that it has withdrawn the application for an electricity generation licence for Cultana Solar Project Company Pty Ltd to operate a 280 megawatt (MW) solar generating plant, located at Whyalla,” it said in its statement.

“Accordingly, the Commission has ceased its assessment of the application.”

A similar statement was issued for the Playford battery, which was to be located at Port Augusta, near the site of the now decommissioned coal fired generators in that city.

It could be that the licence applications will be taken up by whoever buys the rights to the two projects, although it does appear to mean that – at best – the two projects will be delayed, if not cancelled.

It also puts into question the long term supply agreement that the Ross Garnaut-led Zen Energy signed last November with the South Australia state government, which was seen as paving the way for the construction of the Playford battery and the Cultana solar farm.

The 10-year contract – which was put out for tender again after the failure of the Aurora solar thermal project to obtain finance for its ground-breaking solar tower project – was awarded to Zen, but it was backed by the big solar and battery projects to be delivered by its former shareholder, GFG Alliance.

The solar farm was to have been built by 2022 – and was to be the biggest in the state, overtaking the 220MW Bungala facility located not far away near Port Augusta.

The 100MW/100MWh Playford big battery – described as a 135MW battery in the ESCOSA document – was to be completed by 2023 and was to be located close to where the brown coal generator of the same name was once located.

RenewEconomy has reached out to GFG Alliance, Zen Energy and the state government for more information.

https://reneweconomy.com.au/guptas-gfg- ... d-battery/

Re: News & Discussion: Electricity Infrastructure

Another big battery proposal

From Renew Economy

From In Daily

From Renew Economy

As AGL closes some of its gas capacity on Torrens Island.Maoneng plans to trump Hornsdale with big two hour battery near Adelaide

Solar and battery storage developer Maoneng has unveiled plans for a two hour battery near Adelaide that will trump the Hornsdale Power Reserve as the biggest battery storage installation in the state.

The Gould Creek battery will be located around 22kms north of Adelaide, and be sized at 225MW and 450MWh, making it far bigger than the Hornsdale battery which was recently expanded to 150MW and 194MWh.

It comes as transmission companies Transgrid and ElectraNet prepare to begin construction of a new link from South Australia to NSW, a move which will unlock yet more wind and solar projects and support the state’s push to 100 per cent renewables before 2030. It is at around 60 per cent now.

The Gould Creek battery is bigger than any big battery currently operating in Australia, but it won’t rank as the biggest in the country because it will be pipped by the 300MW/450MWh Victoria big battery being built by Hornsdale owner Neoen and which will begin production later this year.

And it may also not likely be the biggest in South Australia, given that AGL has announced that it will fast-track the construction of its Torrens Island battery, which will be sized at up to 250MW and 1,000MWh, after the decision to close one of the gas generators at the site.

Neoen has proposed the biggest battery in South Australia, and the biggest in the country’s main grid, with a huge 900MW/1800MWh facility at its massive Goyder South wind, solar and storage precinct.

Maoneng has a growing portfolio of battery storage projects in the pipeline, although it has yet to start construction. It has signed a deal with AGL to deliver 200MW and 400MWh of battery storage in NSW, including a 50MW/100MWh battery at the Sunraysia solar farm where it is a minority shareholder.

The number of announced and proposed battery storage projects is growing across the country, and also in size and ambition.

While many of the first big battery installations had relatively short storage times because they were focused on grid services such as frequency control and synthetic inertia, the new wave of batteries is more focused on spot arbitrage, by “time shifting” renewables, particularly solar, and meeting evening peaks.

Maoneng’s Gould Creek battery won’t be co-located with a wind or solar farm, but the site has been chosen because it is next to the substation for the Para high voltage line. It is seeking approval from the state government for the project and Crown sponsorship status.

https://reneweconomy.com.au/maoneng-pla ... -adelaide/

From In Daily

AGL turns down gas-fired Torrens Island capacity

AGL Energy will shut down the first of four gas-fired 200MW ‘B’units at its Torrens Island Power Station within three months.

South Australia's Torrens Island power station. Photo: Tony Lewis/InDaily

The company announced this morning it had informed the Australian Energy Market Operator (AEMO) that it intends to mothball the gas-fired Torrens B1 unit in October, a month after it mothballs the last of its Torrens ‘A’ units on Adelaide’s north-western outskirts.

It follows an announcement last week that AGL will demerge into two separate listed companies next year to split its retail and baseload generation functions.

AGL says today’s Torrens Island decision follows the continued decline in South Australian forward prices and the volume of new capacity that has come into the market, creating challenging conditions that do not support the financial viability of operating all four ‘B’ units.

The mothballed unit will take six months to bring back online should market conditions change.

AGL Chief Operating Officer, Markus Brokhof said the decision followed careful consideration of reliable supply against the changes in capacity requirements and pricing.

“We will continue to provide South Australians with access to reliable and affordable electricity. We have assessed all publicly available information and are confident there is sufficient capacity available to AEMO to ensure system strength,” he said.

“Our decision to mothball this unit has no impact on any of our 400 South Australian jobs.

“Torrens Island continues to be an important site for our future generation plans, including its development as a low-carbon industrial energy hub of the future.”

Based on the power station’s maintenance cycle, AGL says the B1 unit is the most appropriate to be mothballed and preserved for a potential recall.

AGL will continue to operate the remaining three 200MW B units, along with the adjacent Barker Inlet power station and will review the decision should there be material changes to the market conditions.

The Torrens Island ‘A’ station’s four 120MW generating units began operating in 1967 with the 800MW ‘B’ station’s four units coming into service in 1976. It is South Australia’s last remaining baseload power generation site.

AGL has already mothballed three Torrens A units, with the remaining unit to be mothballed this September and retirement planned for September 2022.

Its 210MW Barker Inlet Power Station came online in 2019. Stage two of the project is yet to be built but has the potential to double capacity.

The company also announced plans to build a 250MW grid-scale battery on Torrens Island in November, with a final investment decision following in March this year.

“Construction of our 250MW grid-scale battery is planned to begin later this year, making it the first of AGL’s planned 850 MW of batteries to get underway,” Brokhof said.

“This new grid-scale battery along with the Barker Inlet power station that commenced operations in 2019 demonstrates our commitment to playing a leadership role in the state’s energy transition.”

Publicly listed AGL Energy last week confirmed its intention to undertake a demerger to create two energy businesses with separate listings on the Australian Securities Exchange.

Under the demerger proposal, AGL Energy will become Accel Energy Limited, an electricity generation business focused on the accelerating energy transition.

Accel Energy will demerge a new entity, AGL Australia Limited, a multi-product energy-led retailing and flexible energy trading, storage and supply business.

AGL Australia will retain the AGL brand.

Accel Energy will run the Torrens Island operation and the 351MW Hallett Wind Farms in the state’s Mid North as well as the 91MW Wattle Point Wind Farm near Edithburgh on Yorke Peninsula.

It will also be responsible for interstate coal-fired plants Yang A (Victoria), Macquarie Generation (NSW) and Victorian wind farms at Macarthur and Oaklands Hill.

AGL Energy Chairman, Peter Botten, said AGL Energy had created significant value for shareholders in the past through the integration of strong retail and baseload energy generation businesses.

“However, the impact of recent challenging market conditions on our financial performance emphasises that AGL Energy is now at an inflection point, as the transition of the energy sector accelerates, driven by the rapid evolution in renewables and decentralised energy technology, customer needs and community expectations,” he said.

“For Accel Energy, this means focusing on the transition of its existing electricity generation assets and investment in the long-term rejuvenation of its valuable operating sites as low-carbon industrial energy hubs, as well as new clean energy projects.

“For AGL Australia, it means focusing on being Australia’s leading two multi-product energy retailing business while investing in flexible energy trading, storage and supply and decentralised energy services.”

After the demerger, AGL Energy shareholders would hold one share in each of Accel Energy and AGL Australia for every share they own in AGL Energy on the applicable record date.

https://indaily.com.au/news/2021/07/07/ ... -capacity/

Re: News & Discussion: Electricity Infrastructure

And Veolia has scrapped plans for a solar farm and battery at Gillman.

From PV Magazine

From PV Magazine

Veolia scraps plans for South Australian solar farm

Plans to construct a 100 MW solar PV farm and battery energy storage facility at Gillman in South Australia have been scrapped after proponent Veolia failed to ‘meet milestones’ attached to the renewable energy project.

JULY 1, 2021 DAVID CARROLL

Veolia's plans for a solar farm at Gillman have been abandoned.

Image: Renewal SA

French resource management and energy services company Veolia has terminated plans to build a renewable energy hub, featuring a utility scale solar PV farm and battery energy storage system, in Adelaide’s north, citing ‘unforeseen changes to market conditions’.

Veolia had planned to build a grid-scale solar PV farm and energy-from-waste facility at Gillman in north-western Adelaide after striking a $7 million deal with the South Australian government in 2017 to develop about 200 hectares of state-owned land in the industrial suburb.

Veolia’s plans for the site included a solar farm capable of generating 75 MW to 100 MW of power backed up by battery storage. The energy generated by the solar farm was to be dispatched to tenants in the proposed industrial park through a microgrid with any excess exported to the state network.

The agreement with the government became active in June 2018 after Veolia purchased approximately 20 hectares of the Gillman land but a company spokesperson confirmed on Thursday it had scrapped the project.

“In light of global events and unforeseen changes to market conditions, Veolia has come to an agreement with the South Australian government to exit from the Gillman project,” the spokesperson said in a written statement.

“In doing so, the government will be able to move forward with alternative options to maximise the land’s potential through reuse, something we fully endorse and support.”

Government development agency Renewal SA said Veolia had not met the milestones set out in the agreement with the state government and had elected to not take up its option to continue with the project.

Renewals SA project delivery and property general manager Todd Perry said both parties had agreed to terminate the existing project agreements, enabling the government to pursue new options for the land’s use.

‘We are disappointed that Veolia’s development at Gillman will not proceed,” he said

“This land has long been identified as being of economic importance to the state due to its size and location, and Veolia’s departure will delay progress towards the achievement of potential employment generating activities.

“Renewal SA is now reviewing the development strategy and desired outcomes for this site to ensure this immensely strategic and important state landholding can be utilised to drive economic growth into the future.”

https://www.pv-magazine-australia.com/2 ... olar-farm/

Re: News & Discussion: Electricity Infrastructure

The new syncon condensers are about to come online. What do they do? Find out in the article below...

From Renew Economy

From Renew Economy

Old style tech to give major boost to Australia’s shift to wind and solar

It has been a week of records. Just five days ago, the most that Australia’s growing fleet of wind turbines had produced at any one time stood at 5,642MW, a level set in May. By the end of Sunday, that record had been comprehensively smashed a number of times, and now stands nearly 800MW higher at 6,428MW.

Did Australia suddenly install hundreds of new turbines that were switched on in the last week? Not really – some big wind farms did start production, including the country’s biggest at Stockyard Hill, but are still only operating at a fraction of their rated capacity as they go through commissioning.

The biggest contribution – apart from it being a windy weekend – came from a leap in output from South Australia, where there has been no new wind capacity added for a while, but where artificial caps on their output were significantly relaxed.

Trials have begun for the first synchronous condensers to be installed in the South Australian grid. All four – two at the Davenport substation near Port Augusta and two at the Robertstown substation – are expected to begin commercial operations by the end of this month or early August.

These are not exciting technologies – they’ve been used for the past half century or more to fix problems and weaknesses in various parts of the grid, and were thought to have seen their heyday, if they ever really had one.

But the ability of these big spinning machines to provide synchronous generation without actually burning any fuel is proving particularly useful in some parts of the grid, and could be a game changer in South Australia.

This state already leads the world with the share of generation from “variable” renewables, wind and solar, which has averaged just over 60 per cent in the last year.

But it could be so much more – the state has around 2,000MW of wind capacity, and another 330MW of large scale solar (along with 1.6GW of rooftop solar).

But the large scale wind and solar farms have had their combined output capped at less than 1300MW for much of the time (and an absolute cap of 1700MW) because of the need to have a certain amount of “synchronous” generation to keep the grid secure.

That has meant gas turbines have had to be called into service even when they were not needed for their energy. Such directions have been issued hundreds of times in the last two years, at an aggregate cost of tens of millions of dollars.

But the commissioning of the new syncons will change that, and will likely lead to a significant boost in the share of wind and solar in South Australia, and help set new wind output records in the national grid as it has done in the last five days.

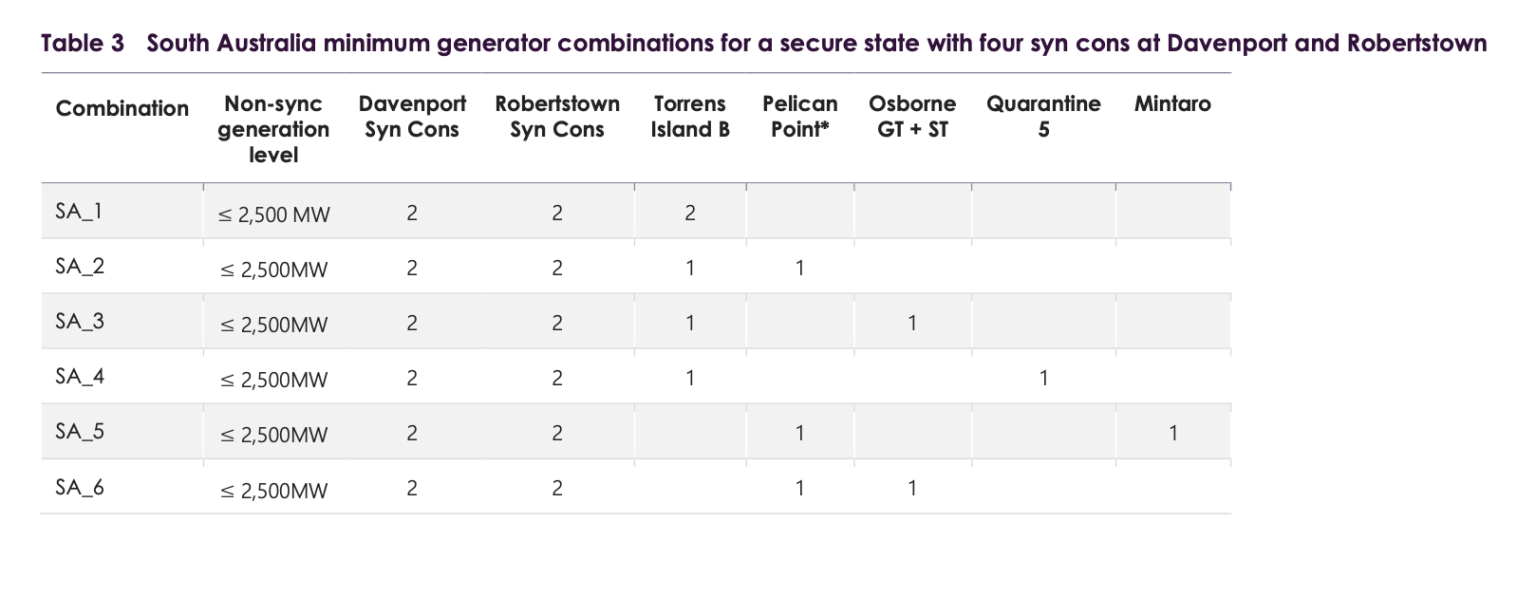

AEMO said earlier this year the additions of two new syncons would allow it to relax the constraints on wind and solar to between 1900MW and 2000MW.

Now, in an update quietly published a week ago, it has revealed that the addition of all four new syncons – now expected in the next week – will allow that combined capacity to produce at up to 2,500MW.

These new combinations and limits will only be applied once all four synchronous condensers – built by global energy heavyweights GE and Siemens – have been tested and operated for up to four weeks without any issues.

Reliability testing at Davenport is well advanced and they are expected to be in operation by the end of the month, but Covid and weather delays have affected Robertstown, so those two syncons may not be available until early August.

The important thing to note here is that under the new guidelines wind and solar will be able to reach these levels with only two other gas generators in operation. Previously, it has required around six or more gas generators to operate to even allow wind and solar to reach the 1700MW cap.

These revised limits will accommodate not just peak production from the current fleet, but the addition of more capacity as the Lincoln Gap wind farm is doubled to around 464MW, and Australia’s biggest hybrid wind and solar facility, the 317MW Port Augusta Renewable Energy Hub, is also switched on.

The next big event in the rapid transition of South Australia’s grid towards the state Liberal government’s target of “net 100 per cent renewables” will be the construction of the new transmission link to NSW, the $2.3 billion Project EnergyConnect.

This which will trigger another major round of renewable energy investment – in both South Australia and NSW – before and after it is opened in late 2024/25.

Already, massive new projects such as Neoen’s Goyder South and its Crystal Brook projects – both combining huge amounts of wind, solar and storage – and Transgrid’s offshoot which is looking at 2.5GW of wind, solar and storage at both ends of the interconnector, but mostly in NSW.

By that time it may be that AEMO and grid owners have become comfortable with battery storage technologies operating in “virtual machine mode”, which allows them to do what syncons do, at a fraction of the cost. The new heyday for syncons may not last long.

And the next step, towards the government’s new target of multiple levels of renewable generation – to satisfy the growing markets for renewable hydrogen and ammonia – will be bringing down the cost of electrolysers.

See also RenewEconomy’s renewable energy maps:

Large Scale Wind Farm Map of Australia

Large Scale Solar Farm Map of Australia

Big battery storage map of Australia

https://reneweconomy.com.au/old-style-t ... and-solar/

Re: News & Discussion: Electricity Infrastructure

Canadian company Amp Energy is pushing forward with its plan for a hydrogen hub at Whyalla.

From Renew Economy

From Renew Economy

Amp Energy secures land for massive solar, battery, green hydrogen play

Plans to establish a renewable hydrogen hub in South Australia’s Whyalla region, and power it with more than a gigawatt of solar and storage, gained ground this week with a site locked in for the first of three solar and big battery projects.

Canadian outfit Amp Energy said on Wednesday that land had been secured for construction of the 388MW Yoorndoo Ilga solar and battery project, with the execution of an agreement for lease with the Barngarla Determination Aboriginal Corporation.

The Yoorndoo Ilga Solar Farm, which will include a 150MW battery (energy storage duration not specified), is one of three South Australian solar and storage projects recently snapped up by Amp Energy as part of a $2 billion plan to create a renewable hydrogen production hub.

The Renewable Energy Hub of South Australia (“REHSA”) will be fed by more than 1,300MW of new solar generation capacity with up to 540MW of big battery capacity (MWh not specified), including the 636MW Robertson project and the 336MW Bungama project – all originally developed by EPS Energy.

Amp said that the lease agreement for the Yoorndoo Ilga project related to land recently secured by BDAC after the SA government’s recognition of the Barngarla People as native title holders of large parts of the Upper Spencer Gulf and Eyre Peninsula.

With land secured, and once development and other approvals were completed, Amp said YIS would create up to 400 equivalent full-time jobs during construction and generate electricity production to power the equivalent of 100,000 homes each year.

The Barngala Corporation said it welcomed the deal with Amp, and looked forward to the benefits of the solar project to its members and to the broader community of Whyalla.

“This is a history making deal and we look forward to Amp developing these projects on our traditional lands, which we now own in fee simple,” said the BDAC Board in a statement.

“Barngarla are proud to be part of the renewable energy revolution in Whyalla and could not think of better partners than Amp and EPS to bring this project to fruition.”

For its part, Amp said it recognised the “significant history and culture” of the traditional owners of the land and

sincerely appreciated the support and trust of the BDAC.

Amp already owns a portfolio of 158MW of solar projects in Australia, after first entering the local market in 2017, including the 39MW Molong solar farm near Orange that commenced full generation in December last year.

Amp said in May that the company’s expansion into South Australia market would see it deploy its Amp X digital energy platform, which provides solutions for grid management, including virtual power plants, demand response services and the optimisation of distributed energy resources like rooftop solar and battery storage.

”The strategic value of the South Australian portfolio is significant in a jurisdiction which is undergoing one of the most rapid energy transitions in the world,” head of the newly formed Amp Australia, Dean Cooper, said in a statement at the time.

https://reneweconomy.com.au/amp-energy- ... ogen-play/

Re: News & Discussion: Electricity Infrastructure

South Australia's first offshore wind farm proposal, 600 mw, near Kingscote in the south east.

https://saoffshorewindfarm.com.au/

https://saoffshorewindfarm.com.au/

Re: News & Discussion: Electricity Infrastructure

New trials for the "flexible" export of solar power. Recommended reading if you are about to install solar panels.

From Renew Economy

From Renew Economy

Flexible PV: South Australia trials new solar export rules as it heads to 100 pct solar

South Australia is introducing new rules for rooftop solar, in a “world-leading” trial of “flexible exports” that will enable the local network operator to handle congestion and over-production in certain parts of the grid.

The trial, which was flagged last October, will begin in a few weeks time in eight suburbs in the south of Adelaide, where rooftop solar penetration is nearing 50 per cent.

Residents in these suburbs who looking to install rooftop solar for the first time will be given a choice of a fixed 1.5kW export limit, or be allowed to export up to 10kW, on the condition that South Australian Power Networks has ability to control and reduce exports when needed.

SAPN insists that any such controls would occur rarely, at most two per cent of the time.

The move is one of many ground-breaking – and in some cases heavily contested – initiatives designed to exert some level of control over rooftop solar, which in states such as South Australia and Western Australia has already become the biggest generation source in their grids.

The Australian Energy Market Operator has predicted that this spring, sometime in the next few months, rooftop solar could account for 100 per cent of the state’s demand – a world first for a gigawatt scale grid, but one that presents a challenge for operator in maintaining grid security.

South Australia last year introduced new inverter standards, and other protocols, that allows AEMO to instruct SAPN and other parties to “switch off” solar to ensure that there is sufficient “minimum demand” to keep the grid stable.

This has already been implemented at least once, and usually will only occur when there is a risk of a network outage, which would leave South Australia’s grid as an effective “island” and create more challenges to maintain security.

However, this is considered a short term move, and may not be needed once a new interconnector is built to NSW, and AEMO is already looking at smarter and more sophisticated options.

Another initiative is the controversial “solar tax”, where networks may be able to charge a per kilowatt hour fee for exports, nominally to ensure that money is spent by the networks to ensure there is enough capacity in the grid.

This, however, will not be introduced for a few years, and it is not clear where, or how, these new tariffs will be delivered. These appear to be more more about seeking to change the pattern of behaviour of solar owners, and provide incentives to shift loads to the daytime and to adopt battery storage.

SAPN says that its new flexible exports option will be available from September 23, and will replace the current system of a fixed limit of 5kW per phase. (Some states have regions where there is a zero export limit).

The initial trial will be in areas served by the Sheidow Park substation, including parts of Hallett Cove, Sheidow Park, Trott Park, Reynella, Old Reynella, Reynella East, O’Halloran Hill and Happy Valley.

The proposal will not affect existing solar customers, or those connecting or upgrading systems in other parts of the network.

“We are in the early stages of this new technology, and Flexible Exports is a world-first that will help us accommodate more solar on our network,” said Mark Vincent, the head of strategy and transformation at SAPN.

“Based on network conditions experienced over the past 12 months, the flexible option would allow customers the opportunity to export 10kW for 98% of the time.

SAPN says more than 46% of households in the targeted area have solar and the local network is reaching its limit to support more solar connections at the current fixed export limit of 5kW. But it says the network is congested at rare times (e.g. mild sunny days in spring).

“We expect that once we have proven the technology and assessed the customer experience that this will become a standard offer for new solar customers in South Australia from mid-2022,” Vincent said.

“It is part of our plan to double the amount of solar that we can accommodate on our network by 2025.”

South Australia currently has around 1.7GW of small scale rooftop solar, and is adding to the capacity at a rate of at least 250MW a year.

Flexible exports are likely to be a feature across the grid, as AEMO and network owners look to innovative ways to marshall and orchestrate behind the meter resources – such as rooftop solar, batteries and electric vehicles – that are likely to account for up to 50 per cent of total generation in coming decades.

Queensland has also been trialling flexible exports at the commercial scale, targeting business customers who might otherwise be put off by the threat of low or zero export limits for what are quite large solar arrays.

Ausnet has also been conducting trials in Victoria, also partly funded by the Australian Renewable Energy Agency, and Western Australia is also looking at the technology.

The partners for SAPN include inverter suppliers Fronius and SMA, along with SwitchDin that is providing communication options, and SolarEdge and others are also expected to sign up.

See also: Flexible exports: It looks like the future of rooftop solar for households

https://reneweconomy.com.au/flexible-pv ... pct-solar/

Giles Parkinson

Who is online

Users browsing this forum: No registered users and 3 guests