The Housing Crisis

The Housing Crisis

anyone here tried to get a rental property lately?

Are we all happy here to have record levels of homelessness, immigration and a housing shortage to go because erm, mOrE dEnSiTy ?

is Albo doing a great job?

Are we all happy here to have record levels of homelessness, immigration and a housing shortage to go because erm, mOrE dEnSiTy ?

is Albo doing a great job?

tired of low IQ hacks

- SouthAussie94

- Legendary Member!

- Posts: 626

- Joined: Tue Mar 27, 2012 10:03 pm

- Location: Southern Suburbs

Re: The Housing Crisis

"All we are is bags of bones pushing against a self imposed tide. Just be content with staying alive"

Views and opinions expressed are my own and don't necessarily reflect the views or opinions of any organisation of which I have an affiliation

Views and opinions expressed are my own and don't necessarily reflect the views or opinions of any organisation of which I have an affiliation

Re: The Housing Crisis

I get that abc is 'controversial', I have him on ignore my self, but for fucks sake do we have to have every thread he posts, or that he posts in, turned into this bullshit with these 2-5 individuals who constantly attack people they don't like?

Not to defend him, but he hasn't posted anything offensive in this instance. If you clowns are that triggered by his posts put him on ignore and grow up already.

How about the moderators actually do something about this ridiculous bullying before a thread descends into a shit slinging match?

I'd say FOMO has more to do with driving up house prices then higher density developments. Houses being sold for tens of thousands more then their actual value.

One of the bank chiefs has also stated that the ridiculous levels of mass migration is part of the problem.

Not to defend him, but he hasn't posted anything offensive in this instance. If you clowns are that triggered by his posts put him on ignore and grow up already.

How about the moderators actually do something about this ridiculous bullying before a thread descends into a shit slinging match?

I'd say FOMO has more to do with driving up house prices then higher density developments. Houses being sold for tens of thousands more then their actual value.

One of the bank chiefs has also stated that the ridiculous levels of mass migration is part of the problem.

Re: The Housing Crisis

Government announced three new developments today "to help with the housing crisis". The northern one was called "Hillier Park" which I thought was odd as the suburb name is just Hillier. Hillier Park is the name of a transportable home retirement village (currently 500 residents), and it turns out has spent the last 12 months preparing to be able to expand onto the next two blocks of rural land as it is full and still receiving enquiries. Its own information says it expected planning consent in late 2023, next step is detailed planning to submit to Town of Gawler for development approval, and they hope to start development in early 2025.

Re: The Housing Crisis

Hi abc,

I understand your opinion, but rest assured, the housing crises is actually nothing to do with Adelaide and is actually originating at a more national level and some in part thanks to the immigration issue you mentioned earlier. Increased density is actually one of the greatest panaceas to a housing crisis, if the government does anything to spur on action that is. Unfortunately for all housing types there isnt enough government assistance, thanks to politicisation of housing, and the lose-lose situation for a government for almost any infrastructure project. Adelaide needs more housing of every type, but especially higher density affordable housing. Happy to discuss

Re: The Housing Crisis

I never took the position that higher density was the cause, its merely the symptom. The reason I mentioned it is because many on this forum are so obsessed with the idea of mOrE dEnSiTy they'll accept it at any price.Levesque wrote: ↑Fri Jan 12, 2024 3:31 pmHi abc,

I understand your opinion, but rest assured, the housing crises is actually nothing to do with Adelaide and is actually originating at a more national level and some in part thanks to the immigration issue you mentioned earlier. Increased density is actually one of the greatest panaceas to a housing crisis, if the government does anything to spur on action that is. Unfortunately for all housing types there isnt enough government assistance, thanks to politicisation of housing, and the lose-lose situation for a government for almost any infrastructure project. Adelaide needs more housing of every type, but especially higher density affordable housing. Happy to discuss

When you say it has nothing to do with Adelaide, it has as much to do with Adelaide as anywhere else in Australia. It could be argued our infrastructure is among the most poorly equipped to deal with it as we're getting a relatively high percentage as compared to the existing population. Being designated a regional town since the Howard government has seen many forced to live here for residence status points...however I'm blaming the current government for increasing migration intake during a nationwide housing shortage.

tired of low IQ hacks

Re: The Housing Crisis

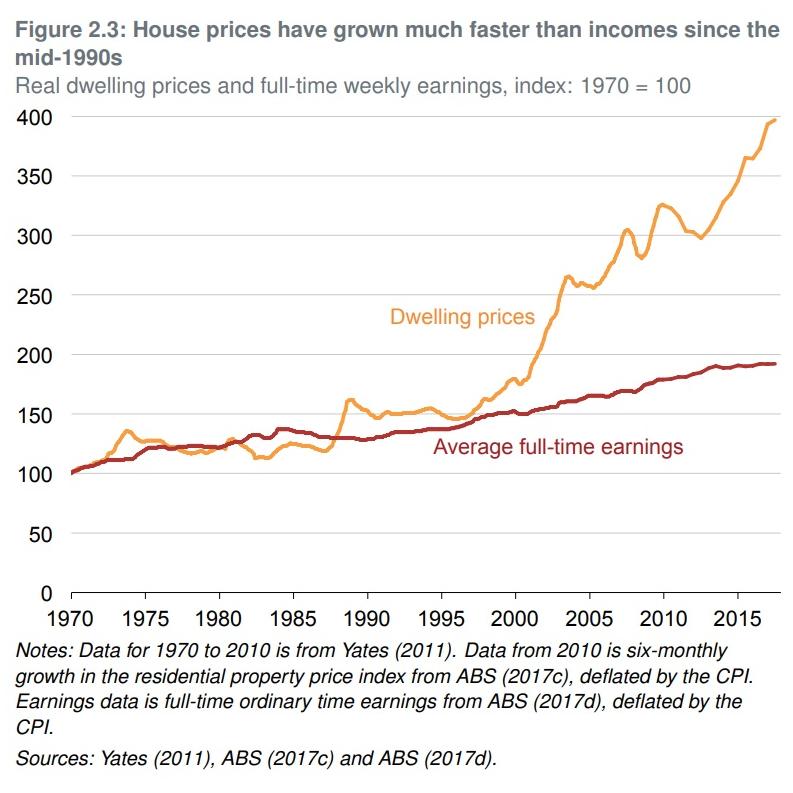

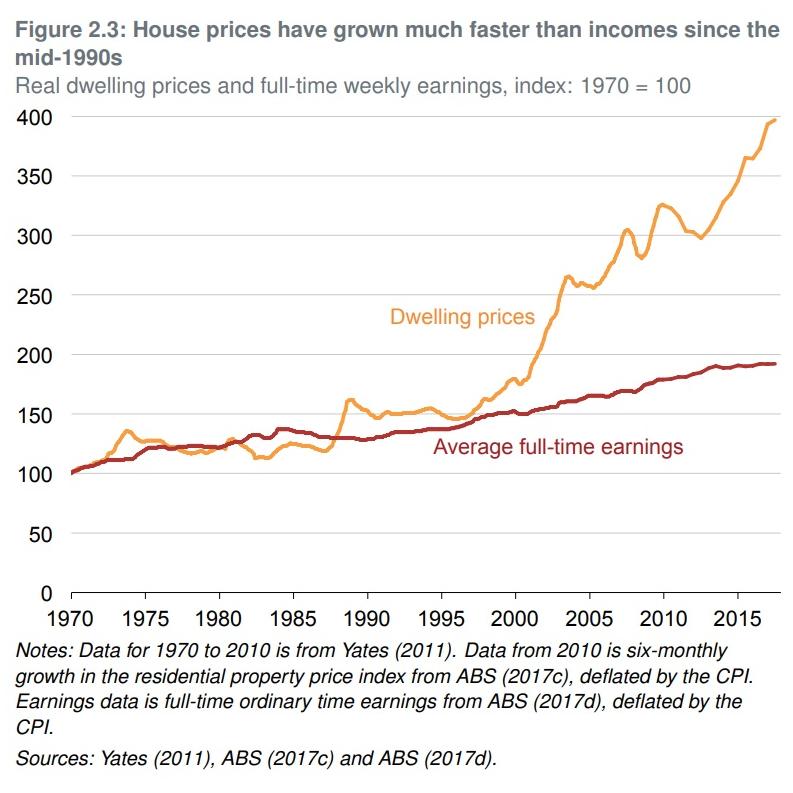

To me, the biggest mistake ever made was the introduction of negative gearing tax laws during the 80's. To turn a necessity like housing into an investment strategy was dire.

I do believe Paul Keating tried to reverse it soon after it was introduced but then back-tracked on that almost immediately.

Property investment has since become so popular (and successful for the investors) that it is far too big to reverse, we are talking in the TRILLIONS of dollars in property values. So much so that it would be a threat to the entire Australian economic system if it was ever canned. Just won't happen.

One idea thrown about is to make future negative gearing available on new builds only. Sounds pretty sensible, but that in turn has problems all of it's own.

I do believe Paul Keating tried to reverse it soon after it was introduced but then back-tracked on that almost immediately.

Property investment has since become so popular (and successful for the investors) that it is far too big to reverse, we are talking in the TRILLIONS of dollars in property values. So much so that it would be a threat to the entire Australian economic system if it was ever canned. Just won't happen.

One idea thrown about is to make future negative gearing available on new builds only. Sounds pretty sensible, but that in turn has problems all of it's own.

Re: The Housing Crisis

https://www.news.com.au/finance/economy ... 6ef2108141

Highlighting the scale of the problem for first homebuyers, research late last year revealed Australians now need to earn more than $300,000 a year to comfortably afford to buy their own home.

The report found the median income required to buy a home on Sydney’s northern beaches was $600,000 per year, and still as high as $283,000 in the city’s outer west and Blue Mountains region.

In Melbourne, an income of nearly $429,000 was needed in the city’s inner-east, while buying a home in Brisbane’s south would require $330,000 per year.

And PropTrack found in a September report that a household earning the median income of $105,000 could now only comfortably afford 13 per cent of homes on the market — the lowest share since relevant data was first collected in 1995.

- ChillyPhilly

- Super Size Scraper Poster!

- Posts: 2860

- Joined: Sun Dec 07, 2008 11:35 pm

- Location: Kaurna Land.

- Contact:

Re: The Housing Crisis

Pretty damning stuff.rev wrote: ↑Wed Jan 31, 2024 7:42 amhttps://www.news.com.au/finance/economy ... 6ef2108141

Highlighting the scale of the problem for first homebuyers, research late last year revealed Australians now need to earn more than $300,000 a year to comfortably afford to buy their own home.The report found the median income required to buy a home on Sydney’s northern beaches was $600,000 per year, and still as high as $283,000 in the city’s outer west and Blue Mountains region.

In Melbourne, an income of nearly $429,000 was needed in the city’s inner-east, while buying a home in Brisbane’s south would require $330,000 per year.

And PropTrack found in a September report that a household earning the median income of $105,000 could now only comfortably afford 13 per cent of homes on the market — the lowest share since relevant data was first collected in 1995.

I think there will be different 'classes' coming out of the past several years:

- Those who can afford a house,

- Those who can afford to rent and move from rental to rental,

- And those who cannot afford either.

Long gone are the days when a householder on a full-time wage earnt enough to afford a mortgage, bills, support a family, and have some fun on the side.

Our state, our city, our future.

All views expressed on this forum are my own.

All views expressed on this forum are my own.

Re: The Housing Crisis

I really do find this continual price rise over the past 20+ years as perplexing. I mean, I do understand the factors at play........ but

I would always think that house prices would plateau at the point where the general population can no longer afford to pay more, but this simply hasn't been the case.

Which means there are people able to pay more and more with no ceiling, which we can only assume are some of the following types:

1. Cashed up overseas investors

2. Cashed up migrants

3. Wealthy older generations helping or even buying property for their offspring

4: The super-wealthy buying up masses of property at will

5. Speculative investors that have numerous properties under their belt, leveraging to buy more

Most of these types are also not affected by interest rate rises, as are not having to take out massive mortgages to pay for these properties i.e paying cash. Therefore they are locking out more and people from buying their first home, whose borrowing capacity is very much dependent on interest rates.

I would always think that house prices would plateau at the point where the general population can no longer afford to pay more, but this simply hasn't been the case.

Which means there are people able to pay more and more with no ceiling, which we can only assume are some of the following types:

1. Cashed up overseas investors

2. Cashed up migrants

3. Wealthy older generations helping or even buying property for their offspring

4: The super-wealthy buying up masses of property at will

5. Speculative investors that have numerous properties under their belt, leveraging to buy more

Most of these types are also not affected by interest rate rises, as are not having to take out massive mortgages to pay for these properties i.e paying cash. Therefore they are locking out more and people from buying their first home, whose borrowing capacity is very much dependent on interest rates.

Re: The Housing Crisis

Supply and demand.

Except due to the past 25 years of fucked up policies that have actively encouraged people to buy multiple properties, it means the demand has increased beyond population growth, even as we haven't been building enough new housing stock even to account for population growth.

Except due to the past 25 years of fucked up policies that have actively encouraged people to buy multiple properties, it means the demand has increased beyond population growth, even as we haven't been building enough new housing stock even to account for population growth.

Re: The Housing Crisis

its not people, its hedge funds that are moving the dialNort wrote: ↑Fri Feb 02, 2024 9:04 amSupply and demand.

Except due to the past 25 years of fucked up policies that have actively encouraged people to buy multiple properties, it means the demand has increased beyond population growth, even as we haven't been building enough new housing stock even to account for population growth.

people owning multiple properties doesn't reduce the supply of rentals... that's all on excess migration intake

tired of low IQ hacks

Re: The Housing Crisis

What hedge funds are active in Australian resi real estate?abc wrote:its not people, its hedge funds that are moving the dialNort wrote: ↑Fri Feb 02, 2024 9:04 amSupply and demand.

Except due to the past 25 years of fucked up policies that have actively encouraged people to buy multiple properties, it means the demand has increased beyond population growth, even as we haven't been building enough new housing stock even to account for population growth.

people owning multiple properties doesn't reduce the supply of rentals... that's all on excess migration intake

Who is online

Users browsing this forum: gnrc_louis, Semrush [Bot] and 4 guests